Increasing Cybersecurity Threats

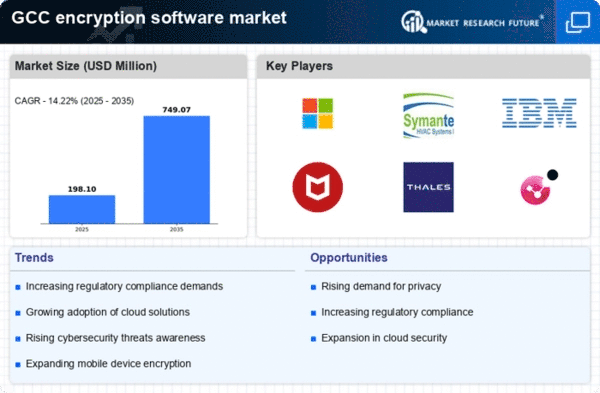

The encryption software market is experiencing a surge in demand. This is due to the escalating cybersecurity threats faced by organizations in the GCC. With cyberattacks becoming more sophisticated, businesses are compelled to adopt robust encryption solutions to safeguard sensitive data. Reports indicate that the region has witnessed a 30% increase in cyber incidents over the past year, prompting a proactive approach to data protection. As organizations prioritize cybersecurity, the encryption software market is projected to grow significantly, with an estimated CAGR of 15% through 2027. This trend underscores the critical role of encryption in mitigating risks associated with data breaches and ensuring compliance with regulatory frameworks.

Rising Awareness of Data Privacy

The encryption software market is benefiting from the growing awareness of data privacy among consumers and businesses in the GCC. As individuals become more conscious of their personal information security, organizations are compelled to adopt encryption solutions to build trust and maintain customer loyalty. Surveys indicate that approximately 65% of consumers in the region prioritize data privacy when choosing service providers. This heightened awareness is driving businesses to invest in encryption technologies, leading to a projected market growth of 10% annually. The emphasis on data privacy not only influences purchasing decisions but also shapes the development of encryption software tailored to meet consumer expectations.

Regulatory Compliance Requirements

The encryption software market is significantly influenced by stringent regulatory compliance requirements. These requirements span various sectors in the GCC. Governments and regulatory bodies are increasingly mandating the use of encryption to protect personal and financial data. For instance, the introduction of data protection laws necessitates that organizations implement encryption measures to avoid hefty fines and legal repercussions. As a result, the encryption software market is expected to expand, with a projected growth rate of 12% annually as businesses invest in compliant solutions. This regulatory landscape not only drives demand for encryption software but also encourages innovation in encryption technologies to meet evolving compliance standards.

Emergence of Advanced Encryption Technologies

The encryption software market is witnessing a transformation. This is due to the emergence of advanced encryption technologies, such as quantum encryption and homomorphic encryption. These innovations are poised to redefine data security standards in the GCC, offering enhanced protection against evolving threats. As organizations seek to future-proof their data security measures, the adoption of these cutting-edge technologies is expected to rise. Analysts predict that the market for advanced encryption solutions could grow by 20% over the next five years, driven by the need for more sophisticated security measures. This trend indicates a shift towards more resilient encryption solutions that can address the complexities of modern data security challenges.

Adoption of Digital Transformation Initiatives

Ongoing digital transformation initiatives across the GCC are propelling the growth of the encryption software market. As organizations transition to digital platforms, the need for secure data transmission and storage becomes paramount. The market is witnessing a shift towards advanced encryption technologies that can seamlessly integrate with emerging digital solutions. It is estimated that by 2026, over 70% of businesses in the region will have adopted some form of digital transformation, thereby increasing the demand for encryption software. This trend highlights the necessity for organizations to protect their digital assets, making encryption a vital component of their overall digital strategy.