Increasing Cybersecurity Threats

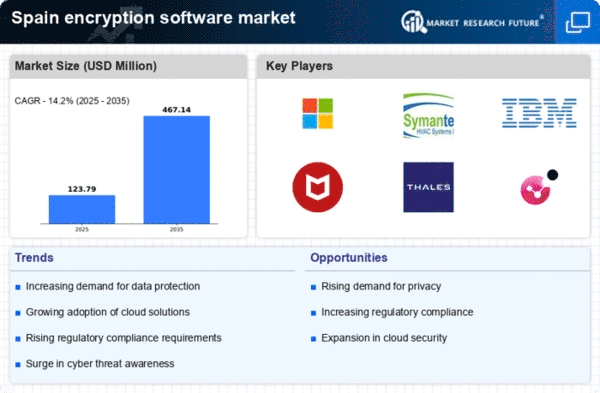

The encryption software market in Spain is experiencing growth. This growth is due to the rising frequency and sophistication of cyber threats. As organizations face an increasing number of data breaches and ransomware attacks, the need for robust encryption solutions becomes paramount. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, prompting Spanish companies to invest heavily in encryption technologies. This trend indicates a shift towards prioritizing data security, as organizations recognize that encryption is a critical component of their cybersecurity strategy. Thus, the encryption software market is likely to expand as businesses seek to protect sensitive information and maintain customer trust.

Regulatory Framework Enhancements

The evolving regulatory landscape is shaping the encryption software market in Spain. With the implementation of stringent data protection laws, such as the General Data Protection Regulation (GDPR), organizations are compelled to adopt encryption solutions to ensure compliance. Non-compliance can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, which incentivizes businesses to invest in encryption technologies. This regulatory pressure is likely to drive the encryption software market as companies seek to mitigate risks associated with data breaches and ensure adherence to legal requirements. The market is expected to grow as organizations prioritize compliance-driven encryption solutions.

Growing Adoption of Cloud Services

The shift towards cloud computing in Spain is significantly influencing the encryption software market. As more businesses migrate their operations to the cloud, the demand for encryption solutions to secure data in transit and at rest is increasing. According to recent data, approximately 70% of Spanish companies are expected to adopt cloud services by 2026, which necessitates the implementation of encryption to safeguard sensitive information. This trend suggests that the encryption software market will continue to thrive as organizations prioritize data protection in their cloud strategies. The integration of encryption with cloud services is likely to become a standard practice, further driving market growth.

Increased Awareness of Data Privacy

In Spain, there is a growing awareness among consumers and businesses regarding data privacy issues. This heightened consciousness is driving the encryption software market as individuals demand greater protection for their personal information. Surveys indicate that over 80% of Spanish consumers are concerned about their data privacy, prompting businesses to adopt encryption technologies to build trust and enhance their reputation. As organizations recognize the importance of safeguarding customer data, the encryption software market is likely to expand. This trend suggests that companies will increasingly invest in encryption solutions to address consumer concerns and comply with privacy expectations.

Technological Advancements in Encryption

The encryption software market in Spain is benefiting from rapid technological advancements. Innovations in encryption algorithms and the development of more efficient encryption methods are enhancing the effectiveness of data protection solutions. For instance, the emergence of quantum encryption technology is poised to revolutionize the market by providing unprecedented security levels. As organizations seek to stay ahead of potential threats, the adoption of advanced encryption technologies is likely to increase. This trend indicates that the encryption software market will continue to evolve, driven by the need for cutting-edge solutions that can address the complexities of modern data security challenges.