Shift Towards Edge Computing

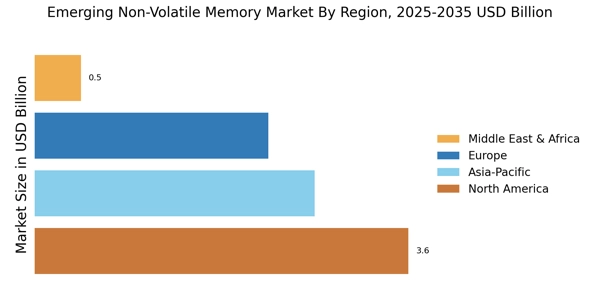

The Emerging Non-Volatile Memory Market is being shaped by the shift towards edge computing, which necessitates efficient data processing and storage closer to the source of data generation. This trend is particularly relevant in IoT applications, where low latency and high reliability are critical. Non-volatile memory solutions are well-suited for edge devices, as they provide the necessary speed and endurance for real-time data processing. As more industries adopt edge computing strategies, the demand for non-volatile memory is expected to rise. Market forecasts indicate that the edge computing segment could drive a 25% increase in the overall non-volatile memory market, reflecting the growing importance of localized data processing.

Integration with Artificial Intelligence

The Emerging Non-Volatile Memory Market is being significantly influenced by the integration of memory solutions with artificial intelligence (AI) technologies. AI applications require rapid data processing and storage capabilities, which non-volatile memory can provide. The ability to store and retrieve data quickly enhances the performance of AI algorithms, making them more efficient and effective. As AI continues to permeate various industries, including healthcare, finance, and automotive, the demand for advanced memory solutions is likely to increase. This trend suggests a potential market expansion, with estimates indicating that AI-driven applications could contribute to a 15% increase in the adoption of non-volatile memory technologies over the next few years.

Rising Demand for Data Storage Solutions

The Emerging Non-Volatile Memory Market is experiencing heightened demand for efficient data storage solutions, particularly from sectors such as cloud computing and big data analytics. As organizations generate and process vast amounts of data, the need for reliable and high-capacity memory solutions becomes paramount. Non-volatile memory technologies, such as 3D NAND and MRAM, are increasingly being adopted due to their ability to provide faster data access and improved endurance. Market analysts indicate that the data storage segment is expected to account for a significant share of the overall market, with projections suggesting a growth rate of around 20% annually as enterprises seek to enhance their data management capabilities.

Growing Adoption in Automotive Applications

The Emerging Non-Volatile Memory Market is seeing a growing adoption of memory solutions in automotive applications, particularly with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). These applications require high-performance memory that can withstand extreme conditions while providing reliable data storage and retrieval. Non-volatile memory technologies, such as NAND flash and FRAM, are increasingly being utilized for their durability and efficiency. The automotive sector is projected to experience a robust growth trajectory, with estimates suggesting that the demand for non-volatile memory in this industry could increase by 30% in the coming years, driven by the need for enhanced safety features and connectivity.

Technological Innovations in Memory Solutions

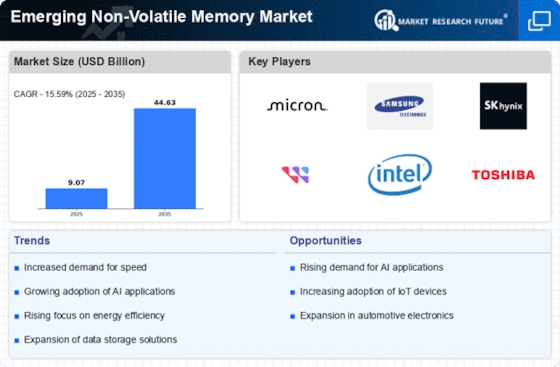

The Emerging Non-Volatile Memory Market is witnessing a surge in technological innovations that enhance memory performance and efficiency. Advancements in materials science, such as the development of new phase-change materials and ferroelectric materials, are paving the way for faster and more reliable memory solutions. These innovations are not only improving data retention and access speeds but also reducing power consumption, which is crucial for mobile and embedded applications. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 25% over the next five years, driven by the increasing need for high-performance memory in various sectors, including consumer electronics and automotive applications.