Regulatory Compliance Driving Demand

Regulatory compliance is a critical driver in the EMC Cable Glands Market, as industries are mandated to adhere to stringent electromagnetic compatibility standards. Various sectors, including telecommunications, automotive, and aerospace, are subject to regulations that necessitate the use of compliant cable glands. This compliance not only ensures the safety and reliability of electronic systems but also mitigates the risk of electromagnetic interference. Consequently, manufacturers are compelled to innovate and produce cable glands that meet these regulatory requirements. The increasing enforcement of such regulations is expected to bolster the demand for EMC cable glands, thereby contributing to the overall growth of the market. As industries prioritize compliance, the EMC Cable Glands Market is likely to witness a surge in demand for high-quality, certified products.

Increased Focus on Safety and Reliability

Safety and reliability are paramount concerns in the EMC Cable Glands Market, particularly in sectors where electronic systems are critical. Industries such as oil and gas, chemical processing, and mining require cable glands that not only provide electromagnetic compatibility but also ensure protection against harsh environmental conditions. The emphasis on safety standards is driving manufacturers to develop cable glands that meet rigorous testing and certification processes. This focus on safety is likely to enhance consumer confidence and drive market growth, as industries prioritize the use of reliable components in their operations. As a result, the EMC Cable Glands Market is expected to expand, with a growing number of companies investing in research and development to create safer and more reliable products.

Growing Industrial Demand for EMC Solutions

The EMC Cable Glands Market is witnessing a surge in demand driven by the growing industrial sector. As industries expand and modernize, the need for effective electromagnetic compatibility solutions becomes paramount. Sectors such as renewable energy, manufacturing, and transportation are increasingly reliant on electronic systems that require robust protection against electromagnetic interference. This trend is reflected in market data, which indicates a steady increase in the adoption of EMC cable glands across various applications. The rise of automation and smart technologies in industrial processes further amplifies this demand, as industries seek to enhance operational efficiency and reliability. Consequently, the EMC Cable Glands Market is positioned for growth, with manufacturers focusing on developing innovative products to meet the evolving needs of these sectors.

Emerging Markets and Infrastructure Development

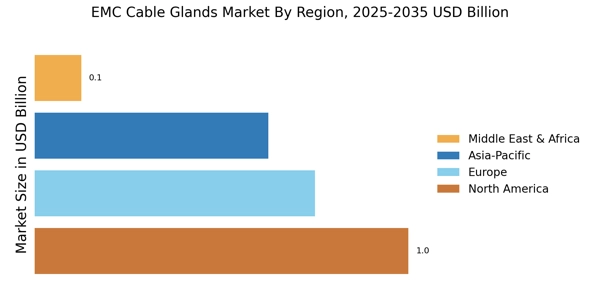

Emerging markets are playing a pivotal role in the growth of the EMC Cable Glands Market, driven by rapid infrastructure development and urbanization. As countries invest in modernizing their infrastructure, the demand for reliable electromagnetic compatibility solutions is increasing. This trend is particularly evident in regions experiencing significant industrial growth, where the need for effective cable management systems is becoming more pronounced. Market data suggests that the expansion of telecommunications and energy sectors in these regions is contributing to the rising demand for EMC cable glands. Consequently, manufacturers are focusing on establishing a presence in these emerging markets, recognizing the potential for substantial growth. The EMC Cable Glands Market is likely to benefit from this trend, as infrastructure development continues to create new opportunities for market players.

Technological Advancements in EMC Cable Glands Market

The EMC Cable Glands Market is experiencing a notable transformation due to rapid technological advancements. Innovations in materials and manufacturing processes are enhancing the performance and reliability of cable glands. For instance, the introduction of advanced polymer materials is improving resistance to environmental factors, thereby extending the lifespan of cable glands. Furthermore, the integration of smart technologies into cable gland designs is facilitating better monitoring and management of electromagnetic interference. This trend is likely to drive market growth, as industries increasingly seek solutions that ensure compliance with stringent electromagnetic compatibility standards. As a result, the EMC Cable Glands Market is poised for expansion, with projections indicating a compound annual growth rate that reflects the increasing adoption of these advanced solutions.