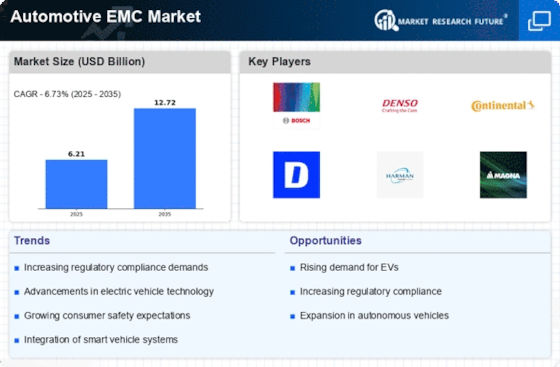

Growth of Connected Vehicles

The proliferation of connected vehicles is reshaping the Automotive EMC Market. With the integration of Internet of Things (IoT) technologies, vehicles are becoming increasingly reliant on wireless communication systems. This connectivity enhances the driving experience but also introduces new challenges related to electromagnetic interference. As the number of connected vehicles is projected to exceed 500 million by 2025, the need for effective EMC solutions to ensure reliable communication and safety becomes critical. Consequently, the Automotive EMC Market is likely to experience substantial growth as manufacturers seek to address these emerging challenges.

Stringent Regulatory Frameworks

The Automotive EMC Market is heavily influenced by stringent regulatory frameworks that govern electromagnetic compatibility. Various international standards, such as ISO 11452 and CISPR 25, mandate rigorous testing and compliance for automotive components. These regulations are designed to ensure that vehicles do not emit excessive electromagnetic interference and can operate effectively in the presence of external electromagnetic fields. As regulatory bodies continue to tighten these standards, manufacturers are compelled to invest in comprehensive EMC testing solutions. This trend not only drives the demand for EMC services but also fosters innovation within the Automotive EMC Market.

Rising Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a pivotal driver in the Automotive EMC Market. As automakers pivot towards electrification, the need for robust electromagnetic compatibility (EMC) solutions becomes paramount. EVs, with their complex electronic systems, require stringent EMC testing to ensure safety and performance. According to industry estimates, the EV market is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This surge in EV production necessitates advanced EMC solutions to mitigate interference and ensure compliance with international standards, thereby propelling the Automotive EMC Market forward.

Advancements in Automotive Electronics

The rapid evolution of automotive electronics is significantly influencing the Automotive EMC Market. Modern vehicles are increasingly equipped with sophisticated electronic systems, including advanced driver-assistance systems (ADAS), infotainment systems, and connectivity features. These innovations demand enhanced EMC testing and solutions to prevent electromagnetic interference that could compromise vehicle safety and functionality. The market for automotive electronics is expected to reach USD 300 billion by 2026, indicating a substantial opportunity for EMC providers. As the complexity of automotive electronics escalates, the demand for effective EMC solutions is likely to rise correspondingly.

Increased Focus on Safety and Reliability

Safety and reliability remain paramount concerns in the Automotive EMC Market. As consumers demand higher safety standards, manufacturers are compelled to ensure that their vehicles meet rigorous EMC requirements. The automotive sector is witnessing a shift towards more comprehensive safety testing protocols, which include EMC assessments. This trend is further supported by consumer awareness and regulatory pressures, leading to a heightened emphasis on the reliability of electronic systems. As a result, the Automotive EMC Market is expected to expand as companies invest in advanced testing methodologies and solutions to enhance vehicle safety and performance.