Embolic Protection Devices Size

Embolic Protection Devices Market Growth Projections and Opportunities

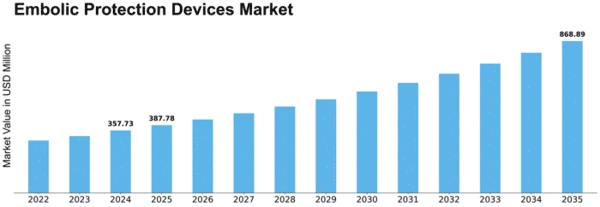

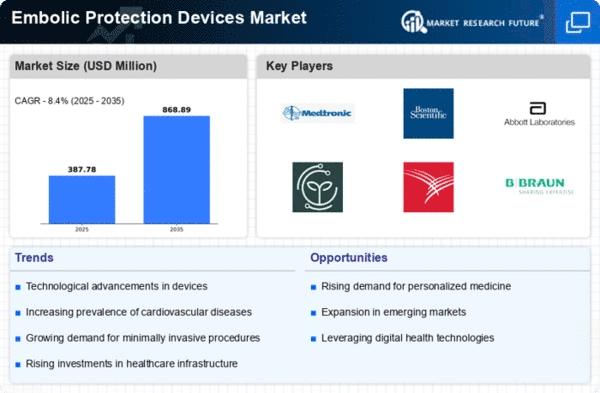

Embolic Protection Devices Market size is projected to reach USD 0.62 billion by 2032 at 8.4% CAGR during the forecast period. The Embolic Protection Devices (EPD) market is significantly influenced by a myriad of market factors that collectively shape its dynamics and growth trajectory. One of the primary drivers is the rising prevalence of cardiovascular diseases, including strokes and coronary artery diseases. With aging populations and the deriving from sedentary lifestyle habits that are responsible for the predicted increase of such diseases, the need for embolic protection devices that are proven to be effective has significantly raised.

Front runner of the market is played by the progressions in the field of medical technology. Due to ongoing research and development work the new updated and more accurately positioned embolic protection devices has been introduced. The later improvements in technology not only improve well the performance of these devices but as well widens their field of applicability beyond the scope of cardiovascular diseases and makes them versatile.

Moreover, evolving recognition between healthcare in the matter of prevention by both care providers and patients has been the catalyst for uptake of embolic protection devices among the people. Discovering and any treatment for probable embolic occurrences to lead to a better medical result for patients is nowadays a key force pushing the sales.

Governments' programs and healthcare implementation strategies play a significant role in embolic protection devices market development. Building a strong social media presence is crucial in today's digital era. With millions of users connected online, companies have the opportunity to engage with their customers directly, showcase their products, and build a loyal brand following. In this article, we will discuss six ways that businesses can build a successful social media presence. When supported by adequate regulatory frameworks and reimbursement policies, choice for certain treatments involving EPDs by healthcare providers will be an incentive for them to use these devices. Therefore, this affects the wholesale market, gaining the opportunity for embolic procedures utilization.

In addition, the market is becoming more driven by the spreading request for minimal methods of intervention. Due to high patient requests and also demand from the healthcare providers for minimally to non-invasive diagnosis, the demand for embolic protection devices increases. They have become one of the most important residential components in the success of minimally invasive medical procedures that have gained prominence worldwide.

Competition in terms of market and available other technologies are the factors that also make the devices market dynamic in nature. Such multiple players that the market outside the competition and innovation in order to make as a result further enhancements related to the device design, functionality, and cost effectiveness. The market dynamics are further influenced by the availability and adoption of alternative technologies or approaches for addressing cardiovascular issues, posing both challenges and opportunities for the embolic protection devices market.

Leave a Comment