Top Industry Leaders in the Embedded Systems Market

Competitive Landscape of the Embedded Systems Market:

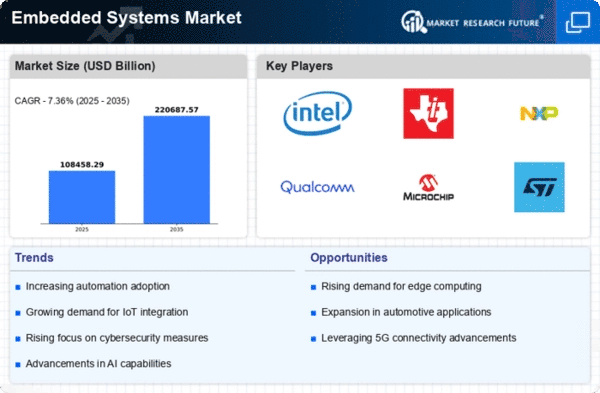

The embedded systems market, encompassing the hardware and software powering countless intelligent devices, stands poised for significant growth in the coming years. Driven by megatrends like automation, artificial intelligence, and the Internet of Things (IoT), this dynamic arena presents both opportunities and challenges for established players and new entrants alike. Analyzing the competitive landscape involves understanding the strategies employed by key participants, the factors influencing market share, and the emergence of disruptive newcomers.

Key Players:

- Kontron AG

- Atmel Corporation

- Analogue devices Inc

- Intel Corporation

- Renesas Electronics Corporation

- Texas Corporation

- Samsun electronic corporation

- Microsoft Corporation

- Infineon Technologies AG

- NXP semiconductors. Inc

Strategies Adopted by Key Players:

- Specialization vs. Diversification: Leading players like NXP, Texas Instruments, and Infineon Technologies often adopt a specialized approach, focusing on specific application areas like automotive or industrial automation. Others, like Renesas and STMicroelectronics, pursue a broader strategy, catering to diverse verticals with a wider product portfolio. The choice between specialization and diversification hinges on factors like core competencies, market demands, and risk tolerance.

- Vertical Integration: Many established players vertically integrate their operations, developing both hardware and software components in-house. This approach offers greater control over product design and enables faster time-to-market. However, smaller companies often rely on partnerships with specialized hardware or software vendors to remain competitive.

- Innovation and Ecosystem Building: Continuous innovation in processor architectures, security solutions, and low-power technologies is crucial for differentiation. Additionally, fostering strong developer ecosystems through tools, reference designs, and technical support plays a vital role in attracting and retaining customers.

- Acquisitions and Strategic Partnerships: Mergers and acquisitions (M&As) enable companies to expand their product offerings, enter new markets, and acquire critical talent. Strategic partnerships can accelerate development efforts, leverage complementary strengths, and share resources.

Factors Influencing Market Share Analysis:

- Geographical Expansion: The geographic distribution of market share varies significantly. North America and Europe currently hold the majority share, but the Asia-Pacific region is witnessing rapid growth driven by factors like rising disposable incomes and increasing industrial automation. Understanding regional dynamics is crucial for accurate market share analysis.

- Application Focus: The embedded systems market caters to diverse applications, including automotive, consumer electronics, industrial automation, and healthcare. Each application segment has unique requirements and growth prospects. Companies with strong positions in high-growth segments like automotive or IoT are likely to gain market share.

- Technology Leadership: Technological advancements in areas like artificial intelligence, edge computing, and low-power electronics are constantly reshaping the embedded systems landscape. Companies at the forefront of these innovations gain a competitive edge and attract clients seeking cutting-edge solutions.

- Price and Performance: Striking the right balance between price and performance is critical for success. While cost remains a significant factor, especially in volume-driven segments, clients increasingly value features like efficiency, reliability, and security, creating opportunities for differentiation.

New and Emerging Companies:

The rise of the IoT and the demand for specialized solutions are giving rise to a new wave of startups and smaller players. These companies often focus on niche applications, leverage open-source platforms, and adopt agile development methodologies, enabling them to disrupt established players and carve out their own space in the market. Examples include Espressif Systems in the Wi-Fi connectivity space and SiFive in the RISC-V processor market.

Industry Developments

Kontron AG:

- Kontron announces strategic partnership with NXP Semiconductors for secure edge computing solutions: (December 12, 2023) Kontron and NXP announced a collaboration to accelerate development and deployment of secure edge computing solutions in areas like industrial automation, medical technology, and transportation. This partnership leverages NXP's edge processing technologies with Kontron's expertise in rugged embedded computing platforms.

- Kontron launches new high-performance SMARC module powered by AMD Ryzen Embedded V2000 Processors: (November 07, 2023) Kontron expands its SMARC portfolio with the KSM7720, a powerful module targeted at demanding industrial applications requiring high performance and low power consumption.

Atmel Corporation (acquired by Microchip Technology in 2016):

- Microchip expands its RISC-V microcontroller (MCU) portfolio with new SAM5X3C series: (January 10, 2024) Microchip introduces a new family of low-power MCUs based on the RISC-V architecture, targeting applications with power and performance constraints. This series complements Microchip's existing Atmel-derived AVR and SAM MCUs.

- Microchip partners with Google Cloud for secure IoT solutions: (October 25, 2023) Microchip and Google Cloud collaborate to create secure IoT solutions using Microchip's Atmel crypto authentication devices and Google Cloud IoT Core for data encryption and secure remote management.