Advancements in 3D Printing Technologies

Advancements in 3D printing technologies are significantly influencing the Electronic Prototyping Market. The evolution of additive manufacturing techniques has enabled designers and engineers to create complex prototypes with unprecedented precision and speed. This technological progress not only reduces material waste but also allows for the production of intricate designs that were previously unattainable. Recent statistics indicate that the 3D printing market is expected to reach a valuation of over 40 billion by 2026, reflecting its growing importance in the prototyping landscape. As 3D printing becomes more accessible and cost-effective, its integration into the Electronic Prototyping Market is likely to expand, fostering innovation and creativity in product design.

Integration of IoT in Prototyping Processes

The integration of Internet of Things (IoT) technologies into prototyping processes is reshaping the Electronic Prototyping Market. IoT enables the development of smart prototypes that can collect and analyze data in real-time, providing valuable insights during the design phase. This capability allows engineers to make informed decisions, ultimately leading to more efficient and effective prototypes. The IoT market is projected to grow significantly, with estimates suggesting it could reach 1 trillion by 2030. As IoT becomes increasingly prevalent, its application in the Electronic Prototyping Market is likely to expand, fostering innovation and enhancing product functionality.

Growing Emphasis on Collaborative Prototyping

The Electronic Prototyping Market is experiencing a growing emphasis on collaborative prototyping practices. As teams become more distributed, the need for tools that facilitate collaboration across geographical boundaries has become paramount. Cloud-based prototyping platforms are gaining traction, allowing multiple stakeholders to contribute to the design process in real-time. This collaborative approach not only enhances creativity but also streamlines communication, reducing the likelihood of errors. Market data indicates that the collaborative software market is expected to grow by over 20% annually, reflecting the increasing importance of teamwork in the prototyping landscape. Consequently, the Electronic Prototyping Market is likely to see a rise in solutions that support collaborative efforts, ultimately leading to more innovative and successful product outcomes.

Rising Demand for Rapid Prototyping Solutions

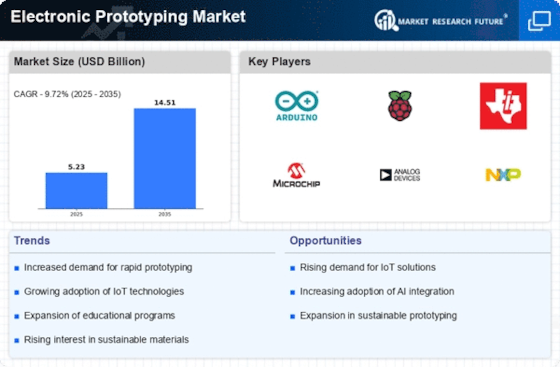

The Electronic Prototyping Market experiences a notable surge in demand for rapid prototyping solutions. This trend is driven by the need for faster product development cycles across various sectors, including electronics, automotive, and consumer goods. Companies are increasingly seeking to reduce time-to-market, which has led to the adoption of advanced prototyping technologies. According to recent data, the market for rapid prototyping is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is indicative of the industry's shift towards more agile methodologies, allowing businesses to iterate designs quickly and efficiently. As a result, the Electronic Prototyping Market is likely to witness a proliferation of innovative tools and platforms that facilitate rapid prototyping, thereby enhancing overall productivity.

Increased Focus on Customization and Personalization

The Electronic Prototyping Market is witnessing an increased focus on customization and personalization of products. As consumer preferences evolve, businesses are compelled to offer tailored solutions that meet specific needs. This shift is particularly evident in sectors such as consumer electronics, where personalized features can significantly enhance user experience. Companies are leveraging prototyping to explore unique designs and functionalities, thereby gaining a competitive edge. Market analysis suggests that the demand for customized products is expected to grow by over 30% in the coming years, prompting manufacturers to invest in flexible prototyping solutions. This trend underscores the importance of adaptability within the Electronic Prototyping Market, as firms strive to align their offerings with consumer expectations.