Top Industry Leaders in the Electronic Chemicals Market

The electronic chemicals market, a crucial cog in the complex machinery of modern electronics, is a dynamic and fiercely competitive space. As miniaturization and performance demands escalate, the need for advanced chemicals with specialized properties grows, shaping a landscape where innovation and strategy reign supreme. This report delves deep into the market's competitive landscape, exploring key players, strategies, and recent developments.

Strategies Shaping the Arena:

-

Technological Prowess: Leading players like Air Liquide, BASF, and Merck KGaA invest heavily in R&D, developing cutting-edge chemicals for advanced applications in semiconductors, displays, and printed circuit boards. This focus on innovation allows them to stay ahead of the curve and cater to the ever-evolving needs of the electronics industry. -

Vertical Integration: Giants like Linde and Cabot Microelectronics are extending their reach across the value chain, acquiring suppliers and expanding into downstream segments. This vertical integration ensures control over critical materials and processes, leading to cost efficiencies and market dominance. -

Regional Focus: With Asia being the largest consumer of electronic chemicals, companies are tailoring their strategies to specific regional demands. Japanese companies like Hitachi Chemical and Shin-Etsu excel in high-purity chemicals, while Korean players like Songwon are carving a niche in advanced electronic polymers. -

Sustainability Spotlight: The growing emphasis on environmental responsibility is pushing companies to develop eco-friendly alternatives and adopt cleaner manufacturing processes. BASF's "eco-etch" chemicals and Solvay's bio-based photoresists are examples of this trend, attracting environmentally conscious customers and investors.

Factors Dictating Market Share:

-

Product Portfolio Breadth: Offering a diverse range of high-performance chemicals across various segments like photoresists, wet chemicals, and specialty gases gives players a competitive edge. Companies like Air Products and Chemicals excel in this aspect, catering to the diverse needs of electronics manufacturers. -

Manufacturing Efficiency and Scale: Efficient production processes and economies of scale allow companies to offer competitive pricing and secure larger contracts. Chinese players like Shanghai Chemical Industry Group and Jiangsu Aoli have gained traction by leveraging their cost advantages. -

Customer Relationships and Partnerships: Building strong relationships with key electronics manufacturers and establishing strategic partnerships with research institutions and universities foster innovation and secure long-term contracts. Air Liquide's collaborations with leading chipmakers and Samsung's partnerships with universities like Stanford are prime examples.

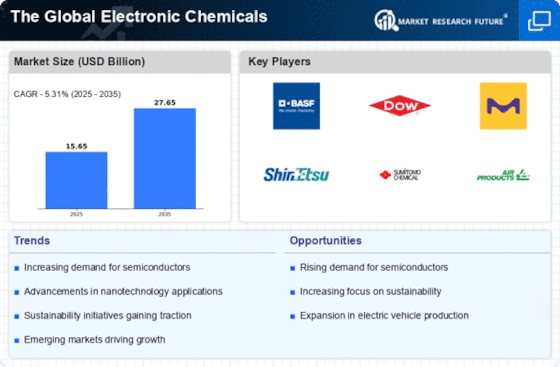

Key Companies in the Electronic Chemicals market include

-

Air Products & Chemicals Inc.

-

Bayer AG

-

Albemarle Corporation

-

Ashland Inc.

-

BASF Electronic Chemicals

-

Air Liquide Holdings Inc.

-

AZ Electronic Materials Plc

-

Honeywell International Inc.

-

Cabot Microelectronics Corporation

-

Linde Group

-

Dow Chemical Company

-

KMG Chemicals Inc.

-

Hitachi Chemical Company

-

Sumitomo Chemical

-

Monsanto Electronic Materials Co.

-

Brewer Science

-

Drex-Chem Technologies

-

EMD Performance Materials Corp.

-

EKC Technology

-

Fujifilm Electronic Materials

-

HD Microsystems

-

High Purity Products

Recent Developments:

May 2023: The rise of electric vehicles and the increasing demand for power electronics create new growth opportunities for electronic chemicals used in battery production.

June 2023: The ongoing trade war between the US and China continues to cast a shadow on the market, with both sides imposing tariffs on electronic chemicals.

July 2023: Increased investments in 5G infrastructure and data centers drive the demand for high-performance electronic chemicals for data storage and transmission.

August 2023: The development of foldable and flexible electronics opens new avenues for the use of specialized electronic chemicals with unique properties.

In 2024: Dow introduced DOWSIL™ 3-8530, a new adhesive designed for advanced electronic applications. It offers high thermal stability and electrical insulation properties, making it suitable for use in semiconductor packaging and other electronic devices.