Advancements in Imaging Technology

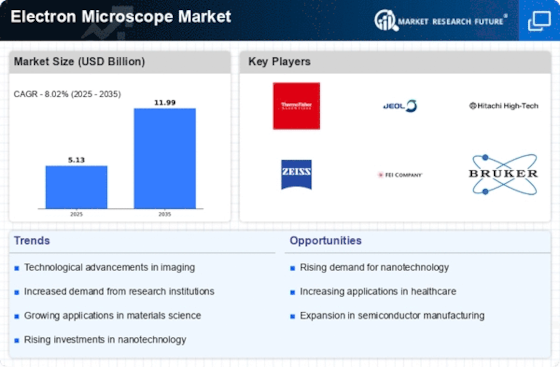

Technological advancements play a pivotal role in shaping the Electron Microscope Market. Innovations such as aberration-corrected electron microscopy and cryo-electron microscopy have significantly enhanced imaging capabilities, allowing for unprecedented resolution and clarity. These advancements enable researchers to visualize materials at the atomic level, which is crucial for various applications, including semiconductor manufacturing and biological research. The market for electron microscopes is projected to grow at a rate of 6% annually, driven by these technological improvements. As new features and functionalities are integrated into electron microscopes, the demand from both academic and industrial sectors is expected to rise, further solidifying the Electron Microscope Market's position in the scientific community.

Growing Applications in Healthcare

The healthcare sector is increasingly adopting electron microscopy for diagnostic and research purposes, which significantly influences the Electron Microscope Market. Scanning Electron Microscopes are instrumental in studying cellular structures and pathogens, providing critical insights that aid in disease diagnosis and treatment development. The market for electron microscopes in healthcare is projected to expand at a rate of 7% annually, reflecting the rising demand for advanced diagnostic tools. As healthcare professionals continue to recognize the value of high-resolution imaging in understanding complex biological systems, the Electron Microscope Market is likely to benefit from this growing trend, leading to further innovations and applications.

Increased Focus on Quality Control

Quality control remains a critical aspect in manufacturing processes, particularly in industries such as pharmaceuticals and electronics. The Electron Microscope Market is witnessing a heightened focus on quality assurance, as companies seek to ensure product integrity and compliance with stringent regulations. Electron microscopes provide essential insights into material properties and defects, enabling manufacturers to maintain high standards. Recent statistics indicate that approximately 30% of companies in the semiconductor sector utilize electron microscopy for quality control purposes. This trend underscores the importance of electron microscopes in enhancing product reliability and performance, thereby driving growth within the Electron Microscope Market.

Emerging Markets and Economic Growth

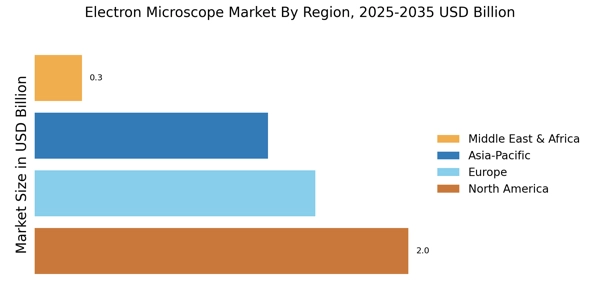

Emerging markets are becoming increasingly important for the Electron Microscope Market, as economic growth in these regions fosters investment in scientific research and industrial applications. Countries in Asia and South America are ramping up their research capabilities, leading to a higher demand for advanced imaging technologies. Recent reports indicate that the Asia-Pacific region is expected to witness a growth rate of 8% in the electron microscope sector, driven by expanding research institutions and industrial applications. This trend suggests that as economies develop, the need for sophisticated analytical tools will likely increase, thereby enhancing the overall landscape of the Electron Microscope Market.

Rising Demand in Research and Development

The Electron Microscope Market experiences a notable surge in demand driven by the increasing investments in research and development across various sectors. Industries such as materials science, biology, and nanotechnology are particularly reliant on advanced imaging techniques provided by electron microscopes. According to recent data, the R&D expenditure in these fields has seen a compound annual growth rate of approximately 5.5%, indicating a robust growth trajectory. This trend suggests that as organizations strive for innovation, the need for high-resolution imaging tools will likely escalate, thereby propelling the Electron Microscope Market forward. Furthermore, academic institutions are increasingly adopting electron microscopy for educational purposes, which further contributes to the market's expansion.