Top Industry Leaders in the Electro Optic Modulators Market

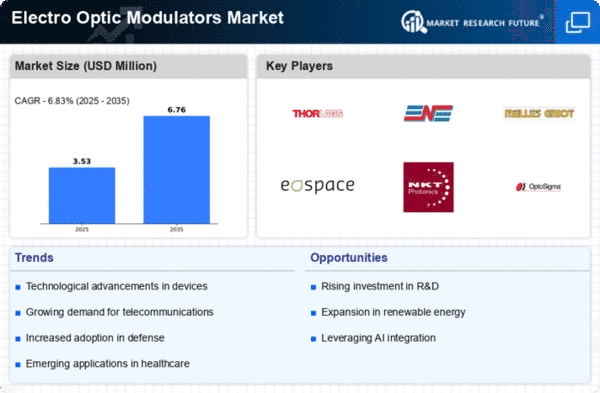

Competitive Landscape of Electro Optic Modulators Market

The electro-optic modulator (EOM) market, pulsates with innovation and fierce competition. These crucial components manipulate light signals, playing a pivotal role in diverse applications like data center communication, medical imaging, and defense technologies. Understanding the competitive landscape is essential for both industry players and potential investors.

Some of the Electro Optic Modulators companies listed below:

- Thorlabs Inc

- GLEAM Optics

- Inrad Optics Inc

- LaserOptik

- Newport Corporation

- Gooch & Housego PLC

Strategies Adopted by Key Players:

- R&D Blitz: Continuous innovation is paramount, with players prioritizing high-bandwidth, low-power consumption, and miniaturization for next-generation modulators.

- Diversification Plays: Established players expand offerings to cater to various applications, while startups specialize in niche technologies, intensifying competition and fragmentation.

- Acquisition Spree: Strategic acquisitions offer faster access to technology and market segments, reshaping competitor portfolios and industry dynamics.

- Partnership Ecosystem: Collaborations with material suppliers, component makers, and system integrators accelerate development and market penetration.

Factors for Market Share Analysis:

- Modulator Type: The market encompasses diverse technologies, such as Mach-Zehnder, lithium niobate (LiNbO3), and silicon photonics. Each type caters to specific needs in terms of bandwidth, operating wavelength, and cost, influencing adoption rates.

- Application Focus: Applications dictate the required modulator specifications. Telecommunication demands high-speed, cost-effective solutions, while defense applications prioritize ruggedness and customizability. This diversity shapes market segmentation and competitor positioning.

- Regional Dynamics: Growth hotspots emerge across the globe. North America remains dominant with established players, while Asia Pacific exhibits rapid expansion fueled by technological advancements and government initiatives. Regional market dynamics influence competitor strategies and growth opportunities.

- Vertical Integration: Some players vertically integrate, controlling aspects like crystal growth and device fabrication. Others focus on specific components or rely on partnerships, impacting their cost structure and market agility.

New and Emerging Companies:

- Silicon Photonics Startups: Companies are developing silicon-based EOMs, promising lower costs, higher integration, and compatibility with existing chip fabrication processes.

- Startups Focusing on Niche Applications: Companies are targeting specific applications like quantum computing and biomedical imaging with specialized EOM designs.

- Universities and Research Institutions: Academic research pushes the boundaries of EOM technology, leading to breakthroughs that attract investment and commercialization opportunities.

Latest Company Updates:

Thorlabs Inc:

- December 15, 2023: Announced the launch of a new series of ultra-high-bandwidth lithium niobate (LiNbO3) EOMs with modulation bandwidths exceeding 70 GHz.

- November 8, 2023: Partnered with the University of Cambridge to develop high-efficiency silicon photonics EOMs for on-chip optical modulation.

GLEAM Optics:

- October 26, 2023: Demonstrated a record-breaking modulation bandwidth of 100 GHz for its silicon photonics EOMs, paving the way for high-speed next-generation optical networks.

- June 14, 2023: Secured USD 25 million in Series B funding to accelerate the development and production of its silicon photonics EOM technology.