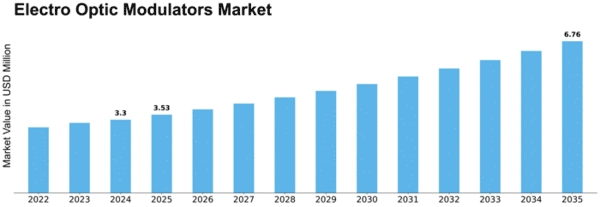

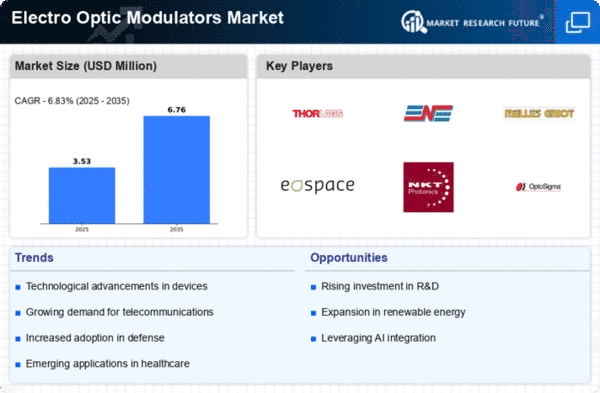

Electro Optic Modulators Size

Electro Optic Modulators Market Growth Projections and Opportunities

Electro-Optic Modulators (EOM) market dynamics are shaped by many factors. Technology is a major factor. As electro-optics evolves, more efficient and advanced modulators are needed. Innovations in materials, design, and production lead to modulators with faster response times and higher modulation depths.

Another major influence on the Electro-Optic Modulators market is demand. Telecommunications, military, and research use modulators for signal processing, communication, and sensing. Electro-optic modulators are in demand due to the global use of fiber optic communication systems. Demand for high-speed data transmission and signal processing in various applications further propels the market.

Economic conditions worldwide affect the Electro-Optic Modulators market. Research and development can rise with economic growth and stability, advancing technology. However, fiscal constraints during economic downturns may hinder research funding and innovation. Material and component costs might also affect electro-optic modulator prices due to currency exchange rate fluctuations.

Regulatory variables affect Electro-Optic Modulator market dynamics. To achieve global product acceptance, manufacturers must comply with international standards and laws. Electro-optic modulator design, manufacture, and marketing can be affected by regulatory changes or new standards, affecting companies' competitiveness.

Recently, environmental concerns have gained attention, affecting the Electro-Optic Modulators market. Eco-friendly technologies and sustainable practises have raised manufacturing process environmental impact awareness. Green and sustainable electro-optic modulator manufacturers may gain a competitive edge as environmental consciousness becomes increasingly important in purchase decisions.

M&As, partnerships, and collaborations shape Electro-Optic Modulators market dynamics. Companies form strategic agreements to expand their markets, product lines, or technology. Mergers and acquisitions can boost market share and change the competitive environment.

Key market companies' R&D investments affect the Electro-Optic Modulators market. Companies that invest much in R&D can introduce innovative products with improved features. Continuous research helps retain a competitive edge and meet end-user needs in many industries.

Leave a Comment