Regulatory Frameworks and Policies

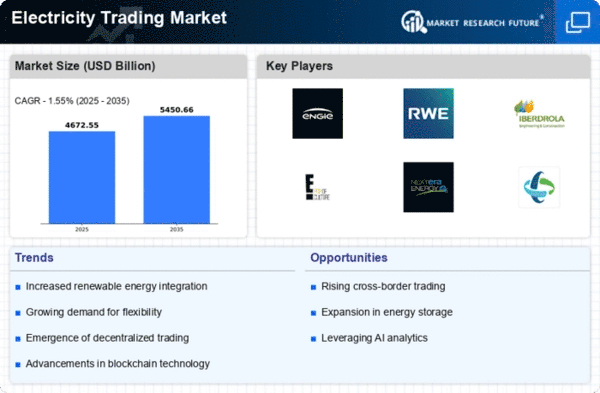

The Global Electricity Trading Market Industry is significantly influenced by regulatory frameworks and policies established by governments worldwide. These regulations often aim to promote competition, enhance market transparency, and encourage investment in infrastructure. For instance, the implementation of carbon pricing mechanisms and renewable energy standards can create favorable conditions for electricity trading. As countries strive to meet international climate commitments, regulatory support is expected to bolster market growth. This evolving landscape may lead to a compound annual growth rate of 1.67% from 2025 to 2035, reflecting the importance of policy in shaping market dynamics.

Rising Demand for Renewable Energy

The Global Electricity Trading Market Industry is experiencing a notable shift towards renewable energy sources, driven by increasing environmental concerns and government initiatives. Countries are investing heavily in solar, wind, and hydroelectric power, which are becoming more cost-competitive. For instance, the share of renewables in global electricity generation is projected to rise significantly, contributing to the market's expansion. This transition is expected to enhance trading opportunities as more renewable energy is integrated into the grid. The market is anticipated to reach 4472.1 USD Billion in 2024, reflecting the growing importance of sustainable energy solutions.

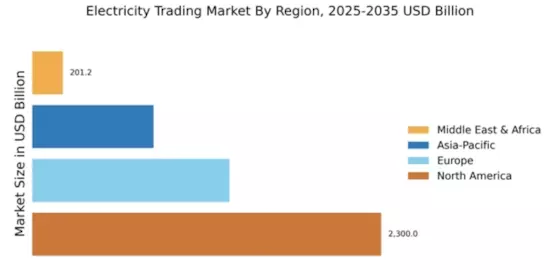

Increased Interconnection Between Markets

The Global Electricity Trading Market Industry benefits from increased interconnection between regional and national electricity markets. Enhanced interconnections facilitate cross-border electricity trading, allowing countries to optimize their energy resources and improve grid reliability. For example, initiatives like the European Union's internal electricity market aim to create a seamless trading environment across member states. This interconnectedness not only promotes competition but also enhances energy security by diversifying supply sources. As interconnections expand, the market is poised for growth, potentially reaching 4472.1 USD Billion by 2024, driven by the need for collaborative energy solutions.

Technological Advancements in Smart Grids

Technological innovations in smart grid infrastructure are transforming the Global Electricity Trading Market Industry. Smart grids facilitate real-time data exchange, enhancing the efficiency of electricity distribution and consumption. These advancements enable better integration of distributed energy resources, allowing for more dynamic trading practices. For example, the deployment of smart meters and advanced analytics tools can optimize energy usage and reduce operational costs. As these technologies proliferate, they are likely to drive market growth, with projections indicating a market size of 5366.8 USD Billion by 2035, underscoring the potential of technology to reshape electricity trading.

Growing Investment in Energy Storage Solutions

Investment in energy storage solutions is becoming a critical driver for the Global Electricity Trading Market Industry. As the share of intermittent renewable energy sources increases, effective storage technologies are essential for balancing supply and demand. Battery storage systems, pumped hydro storage, and other innovative solutions are gaining traction, enabling more flexible trading strategies. For instance, advancements in lithium-ion battery technology have significantly reduced costs, making energy storage more accessible. This trend is likely to support market growth, with expectations of a market size of 5366.8 USD Billion by 2035, highlighting the importance of storage in future electricity trading.