Rising Fuel Prices

The rising prices of fossil fuels are a driving force behind the Global Electric Vehicle Finance Market Industry. As consumers face increasing costs at the pump, many are exploring electric vehicles as a more economical alternative. The long-term savings associated with electric vehicle ownership, including lower fuel and maintenance costs, make them an appealing choice. This shift in consumer behavior is likely to accelerate the transition to electric vehicles, further supported by financing options that make purchasing more accessible. Consequently, the market is poised for substantial growth, with a projected CAGR of 34.51% from 2025 to 2035.

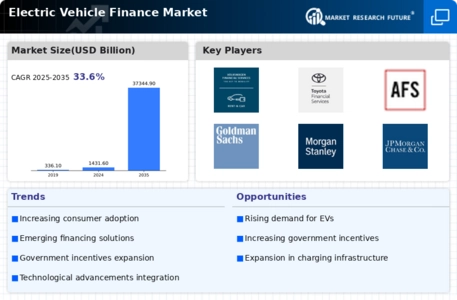

Market Growth Projections

The Global Electric Vehicle Finance Market Industry is poised for remarkable growth, with projections indicating a substantial increase in market size. By 2024, the market is expected to reach 1431.6 USD Billion, and by 2035, it could soar to 37344.9 USD Billion. This growth trajectory suggests a compound annual growth rate (CAGR) of 34.51% from 2025 to 2035. Such figures reflect the increasing consumer demand for electric vehicles, driven by factors such as technological advancements, government incentives, and rising fuel prices. The market's expansion is indicative of a broader shift towards sustainable transportation solutions.

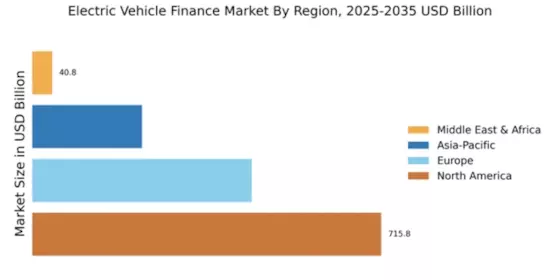

Increased Charging Infrastructure

The expansion of charging infrastructure is a critical driver of the Global Electric Vehicle Finance Market Industry. As more charging stations become available, the convenience of owning an electric vehicle increases, alleviating range anxiety among potential buyers. Governments and private entities are investing heavily in charging networks, with initiatives aimed at ensuring widespread access to charging facilities. This development not only supports current electric vehicle owners but also encourages new buyers to enter the market. With the growing infrastructure, the market is expected to flourish, contributing to the overall growth trajectory of the industry.

Technological Advancements in EVs

Technological advancements in electric vehicles are propelling the Global Electric Vehicle Finance Market Industry forward. Innovations in battery technology, such as increased energy density and reduced charging times, enhance the appeal of electric vehicles to consumers. For example, the development of solid-state batteries promises to significantly improve range and safety. These advancements not only make electric vehicles more attractive but also reduce the total cost of ownership, which is a critical factor for potential buyers. As the technology continues to evolve, the market is expected to expand, with projections indicating a growth to 37344.9 USD Billion by 2035.

Government Incentives and Subsidies

The Global Electric Vehicle Finance Market Industry is significantly influenced by government incentives and subsidies aimed at promoting electric vehicle adoption. Various countries have implemented financial incentives, such as tax credits and rebates, to lower the initial cost of electric vehicles. For instance, in the United States, federal tax credits can reach up to 7500 USD per vehicle, which encourages consumers to consider electric options. This financial support is crucial as it helps bridge the cost gap between electric and traditional vehicles, thereby stimulating market growth. As a result, the Global Electric Vehicle Finance Market is projected to reach 1431.6 USD Billion in 2024.

Environmental Concerns and Regulations

Environmental concerns and stringent regulations regarding emissions are shaping the Global Electric Vehicle Finance Market Industry. Governments worldwide are implementing stricter emissions standards to combat climate change, which is driving consumers and manufacturers towards electric vehicles. For instance, the European Union has set ambitious targets for reducing greenhouse gas emissions, which encourages the adoption of cleaner technologies. This regulatory environment not only fosters innovation but also creates a favorable financing landscape for electric vehicles. As a result, the market is likely to experience robust growth as more consumers seek to comply with environmental regulations.