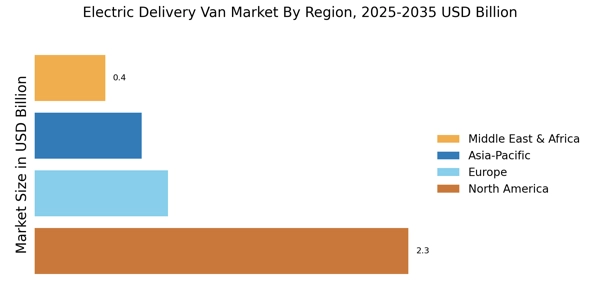

North America : Leading Electric Vehicle Market

North America is witnessing robust growth in the electric delivery van market, driven by increasing demand for sustainable logistics solutions and supportive government policies. The U.S. holds the largest market share at approximately 70%, followed by Canada at around 15%. Regulatory incentives, such as tax credits and emissions standards, are catalyzing this growth, encouraging businesses to transition to electric fleets.

The competitive landscape is dominated by key players like Ford, Rivian, and Workhorse Group, which are innovating to meet the rising demand. The presence of established automotive manufacturers and new entrants is fostering a dynamic market environment. Additionally, advancements in battery technology and charging infrastructure are enhancing the viability of electric delivery vans, making them an attractive option for logistics companies.

Europe : Sustainable Transport Initiatives

Europe is rapidly evolving into a hub for electric delivery vans, driven by stringent environmental regulations and a strong push for sustainable transport solutions. The region's largest market, Germany, accounts for approximately 40% of the market share, followed by the UK at around 25%. The European Union's Green Deal and various national incentives are pivotal in promoting electric vehicle adoption, significantly impacting logistics and delivery sectors.

Leading countries like Germany, the UK, and France are home to major players such as Mercedes-Benz and Arrival, which are at the forefront of innovation. The competitive landscape is characterized by a mix of traditional automotive giants and agile startups, all vying for market share. The emphasis on reducing carbon footprints and enhancing urban air quality is driving investments in electric delivery vans, making Europe a key player in the global market.

Asia-Pacific : Emerging Electric Vehicle Market

The Asia-Pacific region is emerging as a significant player in the electric delivery van market, driven by rapid urbanization and increasing environmental awareness. China leads the market with a share of approximately 60%, followed by Japan at around 20%. Government initiatives, such as subsidies for electric vehicles and investments in charging infrastructure, are propelling the growth of electric delivery vans in this region, addressing the rising demand for efficient logistics solutions.

China's dominance is supported by key players like BYD and Nissan, which are innovating to meet local market needs. Japan is also witnessing growth, with companies like Toyota exploring electric delivery options. The competitive landscape is evolving, with both established manufacturers and new entrants focusing on sustainability and technological advancements, making the Asia-Pacific region a vital market for electric delivery vans.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is gradually recognizing the potential of electric delivery vans, driven by increasing urbanization and a shift towards sustainable transport solutions. While the market is still in its infancy, countries like South Africa and the UAE are leading the charge, with South Africa holding approximately 30% of the market share. Government initiatives aimed at reducing carbon emissions are beginning to catalyze interest in electric vehicles, including delivery vans.

The competitive landscape is characterized by a mix of local and international players, with companies like BYD and local startups exploring opportunities in this emerging market. The region's unique challenges, such as infrastructure development and economic variability, present both hurdles and opportunities for growth. As awareness of electric vehicles increases, the Middle East and Africa are poised for significant advancements in the electric delivery van market.