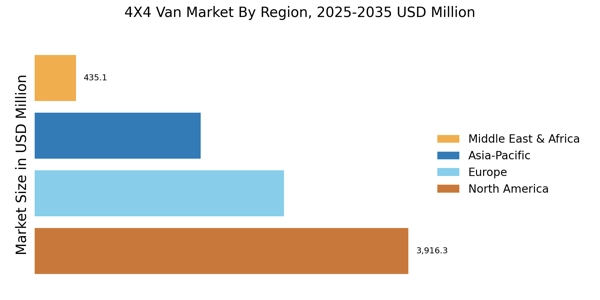

North America : Market Leader in 4X4 Vans

North America is the largest market for 4X4 vans, holding approximately 45% of the global market share. The region's growth is driven by increasing consumer preference for versatile vehicles, coupled with a rise in outdoor recreational activities. Regulatory support for fuel efficiency and emissions standards further catalyzes market expansion, encouraging manufacturers to innovate.

The U.S. and Canada are the primary contributors to this growth, with a strong demand for both commercial and personal use vehicles. The competitive landscape in North America is dominated by key players such as Ford, Chevrolet, and Mercedes-Benz, which offer a range of models tailored to consumer needs. The presence of established automotive manufacturers ensures a robust supply chain and innovation in technology. Additionally, the growing trend of e-commerce and last-mile delivery services is boosting demand for 4X4 vans, making it a critical segment for automotive companies in the region.

Europe : Emerging Market with Regulations

Europe is witnessing a significant shift in the 4X4 van market, holding around 30% of the global share. The region's growth is propelled by stringent environmental regulations and a rising demand for sustainable transportation solutions. Countries like Germany and the UK are leading this trend, with government incentives promoting electric and hybrid 4X4 vans.

The focus on reducing carbon emissions is a key driver, influencing consumer choices and manufacturer strategies. Leading countries in Europe include Germany, the UK, and France, where major players like Volkswagen and Mercedes-Benz are investing heavily in electric vehicle technology. The competitive landscape is characterized by innovation, with manufacturers adapting to changing consumer preferences for eco-friendly options. The presence of a well-established automotive industry supports the growth of 4X4 vans, making Europe a dynamic market for future developments.

Asia-Pacific : Rapid Growth and Urbanization

Asia-Pacific is emerging as a significant player in the APAC 4X4 van market, accounting for approximately 20% of the global share. The region's growth is fueled by rapid urbanization, increasing disposable incomes, and a growing preference for versatile vehicles. Countries like China and Japan are at the forefront, with government initiatives supporting the development of advanced automotive technologies. The demand for 4X4 vans is also rising in rural areas, where these vehicles are essential for transportation and logistics. China is the largest market in the region, with a strong presence of local manufacturers alongside global players like Toyota and Nissan. The competitive landscape is evolving, with companies focusing on innovation and sustainability to meet consumer demands. The increasing popularity of outdoor activities and adventure tourism is further driving the demand for 4X4 vans, making Asia-Pacific a key region for market expansion.

Middle East and Africa : Untapped Potential and Growth

The Middle East and Africa region is gradually emerging in the 4X4 van market, holding about 5% of the global share. The growth is primarily driven by increasing urbanization, a rise in tourism, and a growing demand for off-road vehicles. Countries like South Africa and the UAE are leading this trend, with a strong preference for 4X4 vans in both commercial and recreational sectors.

The region's diverse terrain and climate further enhance the appeal of these vehicles, making them essential for various applications. In the competitive landscape, key players such as Toyota and Ford are well-positioned, offering a range of models suited for the region's unique demands. The presence of a growing middle class and increasing disposable incomes are expected to drive future growth. Additionally, government initiatives aimed at improving infrastructure and transportation networks will further support the expansion of the 4X4 van landscape in this region.