Market Analysis

In-depth Analysis of Electric Commercial Vehicle Market Industry Landscape

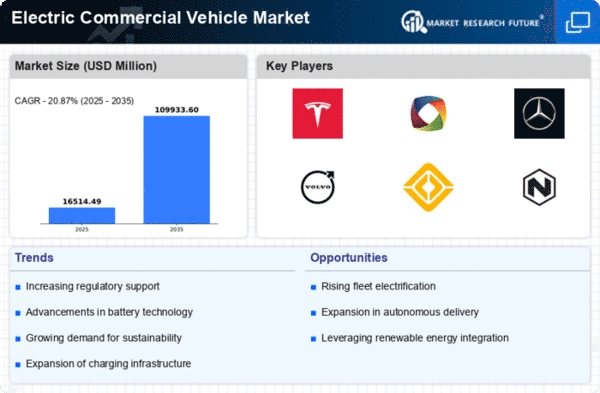

The global electric commercial vehicle market is set to reach US$ 54.29 BN by 2030, at a 29.90% CAGR between years 2023-2030. In recent years, the market has witnessed dynamic changes and tremendous growth that is primarily driven by a range of factors altering its dynamics. As one of the key trends to this movement is sustainability’s globalization and reduction in carbon emissions. Commercial electric vehicles are becoming more popular because governments and businesses alike understand the need to transition into greener sources of energy. Government policies and regulations help determine the market trends of electric commercial vehicles. A number of countries are providing incentives, subsidies and positive regulations to encourage the market for electric vehicles. Such measures usually involve tax relief, grants as well as exemptions from some regulatory standards to make businesspeople buy electric fleets. Moreover, the strict emission controls implemented by governments across the world have prompted companies to switch and utilize electric commercial vehicles in order to adhere with environmental guidelines. The development of this industry has been driven by technological developments and innovations in the battery technology field. The range anxiety, one of the biggest issues hindering EV uptake has been resolved by developing more powerful batteries with a longer distance. The manufacture of newer and better batteries should ensure that the prices continue to drop, making electric vehicles much cheaper than commercial vehicles powered by fossil fuels. As a result of heightened concerns regarding impacts being caused by regular transport fuels, there is now strong shift in customer expectations. Sustainability practices are being embraced by companies, and customers have also become environment-friendly relating to their business choices. Consumer demand for ecologically responsible solutions in transportation has forced companies to invest in electric commercial vehicles as their corporate sustainability strategy. Electric vehicles infrastructure is another major consideration that influences the market dynamics. The convenience of charging stations is an important factor in the popularization of electric commercial vehicles. To address concerns related to charging convenience and range limitations, governments are investing resources into infrastructure for powering the e-vehicles through their use in a national strategy. With the ongoing development of the charging infrastructure, it also becomes a factor in increasing confidence for businesses to invest heavily on electric commercial vehicles. This is because traditionally costs have been a key issue in the implementation of new technologies and the same applies to Electric Commercial Vehicle Market.

Leave a Comment