Rising Focus on Energy Efficiency

The rising focus on energy efficiency is a significant driver for the Commercial Vehicle Electric Power Distribution Box Market. As businesses strive to reduce operational costs and minimize their carbon footprint, the demand for energy-efficient solutions is increasing. In 2025, the emphasis on energy efficiency in commercial vehicles is expected to lead to a surge in the adoption of electric power distribution systems that optimize energy usage. This trend is further supported by advancements in power electronics and control systems, which enhance the performance of electric power distribution boxes. Consequently, manufacturers are likely to invest in developing innovative solutions that meet the growing demand for energy-efficient commercial vehicles, thereby propelling the market forward.

Advancements in Battery Technology

Advancements in battery technology are significantly influencing the Commercial Vehicle Electric Power Distribution Box Market. As battery systems become more efficient and compact, the integration of power distribution boxes must evolve to accommodate these innovations. The development of solid-state batteries and improvements in lithium-ion technology are expected to enhance vehicle performance and range, which in turn increases the complexity of power management systems. In 2025, the market for advanced battery technologies is anticipated to reach several billion dollars, indicating a robust growth trajectory. This evolution necessitates sophisticated power distribution solutions that can optimize energy flow and ensure safety, thereby driving demand for electric power distribution boxes in commercial vehicles.

Regulatory Support for Electrification

Regulatory support for the electrification of commercial vehicles is a crucial driver for the Commercial Vehicle Electric Power Distribution Box Market. Governments worldwide are implementing stringent emissions regulations and offering incentives for electric vehicle adoption. In 2025, numerous countries are expected to enforce regulations that mandate a significant reduction in greenhouse gas emissions from commercial fleets. This regulatory landscape encourages manufacturers to invest in electric power distribution systems that comply with new standards. As a result, the market for electric power distribution boxes is likely to expand, as manufacturers seek to develop compliant solutions that enhance vehicle efficiency and reduce environmental impact.

Increasing Demand for Electric Vehicles

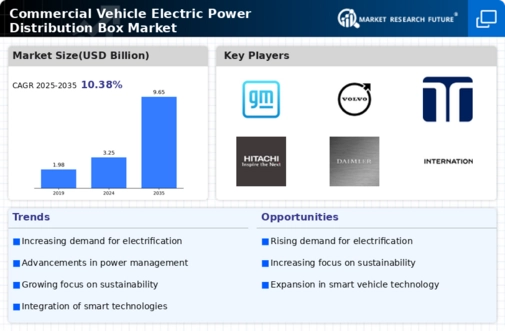

The rising demand for electric vehicles (EVs) is a primary driver for the Commercial Vehicle Electric Power Distribution Box Market. As more manufacturers pivot towards electric models, the need for efficient power distribution systems becomes critical. In 2025, the market for electric commercial vehicles is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 20%. This shift necessitates advanced power distribution solutions that can handle the unique requirements of electric drivetrains, thereby propelling the demand for electric power distribution boxes. Furthermore, as fleet operators seek to reduce operational costs and enhance sustainability, the adoption of electric vehicles is likely to accelerate, further stimulating the market for these essential components.

Growth of Smart Fleet Management Solutions

The growth of smart fleet management solutions is reshaping the Commercial Vehicle Electric Power Distribution Box Market. Fleet operators are increasingly adopting technologies that enable real-time monitoring and management of vehicle performance. This trend necessitates advanced power distribution systems that can integrate with telematics and other smart technologies. In 2025, the market for fleet management solutions is projected to grow substantially, with estimates indicating a CAGR of around 15%. As fleets transition to electric vehicles, the need for sophisticated power distribution boxes that can support these technologies becomes paramount. This integration not only enhances operational efficiency but also drives the demand for innovative power distribution solutions.