Regulatory Framework Enhancements

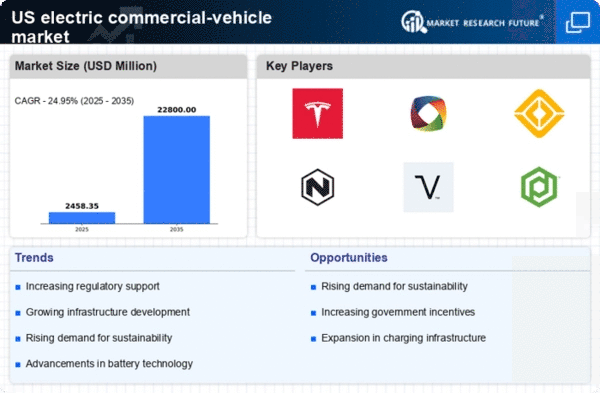

The electric commercial-vehicle market is experiencing a transformation due to evolving regulatory frameworks. Federal and state governments are implementing stricter emissions standards, which compel businesses to transition to electric vehicles. For instance, the Environmental Protection Agency (EPA) has set ambitious targets for reducing greenhouse gas emissions from commercial fleets. This regulatory push not only encourages the adoption of electric vehicles but also fosters innovation within the industry. As a result, manufacturers are investing heavily in research and development to meet these new standards. The electric commercial-vehicle market is thus likely to see a surge in demand as companies seek compliance with regulations, potentially leading to a market growth rate of over 20% annually in the coming years.

Corporate Sustainability Initiatives

In the electric commercial-vehicle market, corporate sustainability initiatives are becoming increasingly prevalent. Many companies are adopting green policies to enhance their brand image and meet consumer expectations for environmentally friendly practices. This shift is particularly evident in logistics and delivery sectors, where firms are committing to reducing their carbon footprints. A recent survey indicated that over 60% of logistics companies plan to invest in electric vehicles within the next five years. This trend not only aligns with corporate social responsibility goals but also positions companies favorably in a competitive market. As businesses prioritize sustainability, the electric commercial-vehicle market is poised for substantial growth, driven by the demand for cleaner transportation solutions.

Increased Focus on Urban Air Quality

The electric commercial-vehicle market is gaining traction. This growth is due to heightened awareness of urban air quality issues. Cities across the US are grappling with pollution and its adverse health effects, prompting local governments to implement measures aimed at reducing emissions from commercial vehicles. Initiatives such as low-emission zones and incentives for electric vehicle adoption are becoming more common. For instance, several major cities have introduced grants for businesses that transition to electric fleets. This focus on improving air quality not only benefits public health but also drives demand for electric commercial vehicles. As urban areas continue to prioritize cleaner air, the electric commercial-vehicle market is expected to grow, supported by both regulatory measures and public sentiment.

Rising Fuel Prices and Economic Pressures

The electric commercial-vehicle market is being influenced by rising fuel prices and economic pressures. As fossil fuel costs continue to fluctuate, businesses are increasingly seeking alternatives to mitigate operational expenses. Electric vehicles offer a more stable and predictable cost structure, as electricity prices tend to be less volatile than gasoline or diesel. A recent analysis suggests that companies can save up to 50% on fuel costs by switching to electric vehicles. This economic incentive is driving fleet operators to consider electric options more seriously. Consequently, the electric commercial-vehicle market is likely to witness accelerated adoption as businesses aim to enhance their profitability while reducing their reliance on traditional fuel sources.

Technological Innovations in Battery Technology

Technological advancements in battery technology are significantly impacting the electric commercial-vehicle market. Innovations such as solid-state batteries and improved lithium-ion technologies are enhancing vehicle range and reducing charging times. These developments are crucial for commercial applications, where downtime can lead to substantial financial losses. For example, the latest battery technologies are expected to increase energy density by up to 30%, allowing vehicles to travel longer distances on a single charge. This improvement not only boosts the appeal of electric commercial vehicles but also addresses concerns regarding range anxiety among fleet operators. As battery technology continues to evolve, the electric commercial-vehicle market is likely to expand, attracting more businesses to transition from traditional fuel sources.