Market Analysis

In-depth Analysis of Edge AI Software Market Industry Landscape

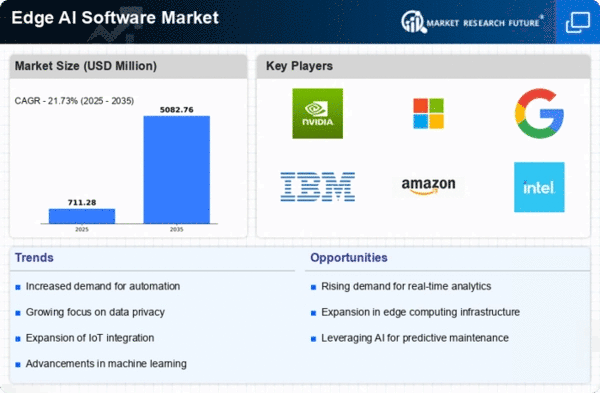

The Edge AI software market is shaped by edge figuring and artificial intelligence, taking into account the growing need for continuous information processing and analysis at the organization's edge. Edge AI takes information management away from uniform cloud frameworks to decentralized, on-gadget computation. The need for faster response times, reduced dormancy, and improved security in smart devices to current computers drives this move.

The rapid expansion of IoT devices is driving the Edge AI software industry. As the number of connected devices grows, there is a compelling need to manage data locally, at the organization's edge, rather than transmitting it to cloud servers. Edge AI software allows edge devices to do smart computations independently without relying on server farms.

The Edge AI software business relies heavily on broadcast communications. Telecom managers are embracing Edge AI to improve efficiency and performance. Telecom companies may improve transfer speed, idleness, and administration by transmitting AI computations at the organization edge. This integration of Edge AI in media communications benefits network executives and offers up new prospects for vision maintenance and organization security.

New companies and IT giants compete for market share in the Edge AI software industry. New firms are pioneering Edge AI solutions for medical services, manufacturing, and retail. Layout players are using their assets to build Edge AI levels for a broad range of use cases. This range of contributions creates a strong market by giving customers options based on their needs.

Edge AI software is increasingly dominated by coordinated efforts and groups. Hardware, software, and system integrators are collaborating to synchronize Edge AI capabilities from start to finish. These cooperative initiatives seek to promote Edge AI adoption by providing enterprises with turnkey solutions that boost functional efficiency and dynamic cycles.

However, Edge AI software market obstacles persist. AI computations on edge devices must account for power, energy efficiency, and capacity limits. Engineers and organizations wishing to use Edge AI must balance the need for extensive AI capabilities with edge device limits.

Information security and protection also impact the industry. As AI processing moves closer to the data source, data security at the edge is prioritized. Designers and associations are investing in strong security measures to guarantee data integrity and client security in Edge AI.

Leave a Comment