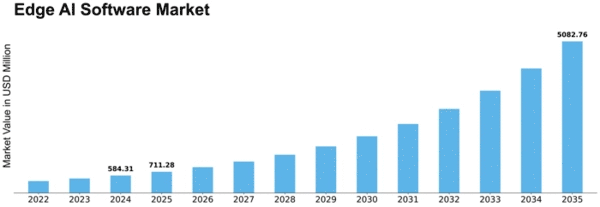

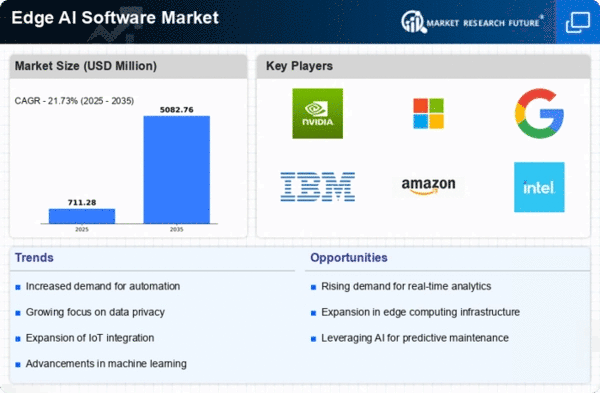

Edge Ai Software Size

Edge AI Software Market Growth Projections and Opportunities

Organizations use various techniques to minimize their market offer and obtain an edge in the fast-growing Edge AI software sector. One popular strategy is separation, where companies focus on Edge AI features and skills. This might comprise high-level AI computations, continuous information management, or enterprise-specific applications. Companies emphasize these differentiators to attract customers seeking cutting-edge and customized solutions, creating a market scenario.

Another popular Edge AI software strategy is cost management. This strategy aims to make companies the lowest-cost supplier by improving procedures, forming good partnerships with technology suppliers, and conducting effective expense board practices. These companies target a large customer base by providing low prices, particularly those that value cost above cutting-edge features or premium services.

Market entry methods help Edge AI software providers grow. Increase marketing, penetrate new geographical markets, and target unexplored clientele. As Edge AI gains popularity, companies use it to identify strengths in growing industries and capture more market share.

Cooperation and organizations are crucial for Edge AI software market players. Collaborating with other innovation providers, industry participants, or research foundations may boost comprehensive arrangements, aid contributions, and shared assets. Cooperative undertakings allow businesses to unite expertise and resources, enhancing their seriousness and addressing tough Edge AI issues.

Additionally, Edge AI software market share depends on development. Organizations invest on innovation to stay ahead of mechanical advances. This involves constantly improving computations, software performance, and edge figuring issues. Companies differentiate themselves from competitors and ensure the importance of their Edge AI solutions in a rapidly changing mechanical context by always upgrading.

Leave a Comment