Top Industry Leaders in the Dry Transformer Market

*Disclaimer: List of key companies in no particular order

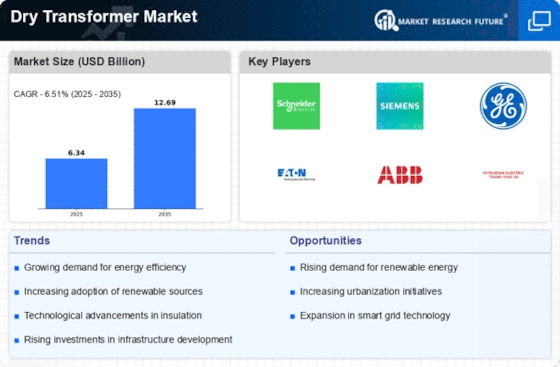

The dry transformer market is experiencing heightened activity, propelled by escalating concerns about fire safety, stringent environmental regulations, and the expansion of renewable energy sources and data centers. This market brims with promising opportunities for both established players and new entrants. However, successfully navigating this dynamic landscape necessitates a profound understanding of the competitive dynamics at play.

Key Players and Strategies:

The landscape is shaped by a roster of key players, including Hammond Power Solution Inc. (Canada), ABB Ltd. (Switzerland), Siemens AG (Germany), General Electric (U.S.), Jinpan International Ltd. (China), Schneider Electric (France), TBEA Transformer Industrial Group (China), Eaton Corporation (Ireland), Crompton Graves Ltd. (India), Voltamp Transformer Ltd. (India), Virginia Transformer Corp (U.S), Kirloskar Electric Company (India), Kotsons Pvt. Ltd (India), and others.

-

Global Giants: Siemens, Schneider Electric, ABB, and Eaton Corporation dominate the market with their extensive experience, diverse product portfolios, and robust brand recognition. These industry leaders prioritize continuous innovation, offering high-efficiency transformers and tailored solutions, particularly for data centers and renewable energy applications. Strengthening global reach through acquisitions and strategic partnerships with regional players is a key component of their strategies.

-

Regional Champions: Companies like WEG in Brazil, Crompton Greaves in India, and TBEA in China command significant shares in their respective regions. Leveraging their understanding of local regulations, cost-effective manufacturing, and robust distribution networks enables effective competition. These companies focus on developing application-specific transformers for industries such as mining and infrastructure, reinforcing their competitive edge.

-

Emerging Challengers: Startups and smaller players are entering the market with niche offerings and disruptive technologies. Their key differentiators include an emphasis on renewable materials, smart transformers with integrated monitoring capabilities, and compact designs tailored for space-constrained applications. Often targeting specific segments like commercial buildings or microgrids, these players carve out unique market positions.

Market Share Analysis Factors:

Several factors contribute to a company's market share:

-

Product Portfolio: Offering a diverse range of dry transformers in terms of voltage ratings, kVA capacity, and cooling technologies (air-cooled, cast-resin, etc.) caters to varied customer needs and expands market reach.

-

Geographical Presence: A robust global footprint with manufacturing facilities and distribution networks across key regions ensures timely delivery and reduces logistical challenges.

-

Technological Innovation: Investment in research and development to create advanced transformer designs, eco-friendly materials, and smart grid integration features provides a competitive edge in a rapidly evolving market.

-

Sustainability Practices: Adhering to environmental regulations and utilizing recycled materials resonates with customers seeking sustainable solutions.

-

Brand Reputation & Customer Service: Building trust through reliable products, responsive service, and technical expertise fosters long-term customer relationships and market loyalty.

New & Emerging Trends:

-

Focus on Sustainability: Biodegradable materials like vegetable oil are replacing mineral oil in transformer coolants, minimizing environmental impact.

-

Smart Transformers: Integration of sensors and AI-powered monitoring systems enables real-time data analysis, optimizing performance and predictive maintenance.

-

Miniaturization & Compact Designs: Transformers are becoming smaller and lighter, catering to space-constrained applications like data centers and distributed generation projects.

-

Digitalization & Connectivity: Integration with building management systems and smart grids facilitates remote monitoring and control, enhancing efficiency and reliability.

-

Circular Economy Practices: Recycling and refurbishing transformers are gaining traction, reducing waste and promoting resource efficiency.

Overall Competitive Scenario:

The dry transformer market is marked by intense competition, where established players leverage their resources and brand recognition, while smaller players carve out niches through innovation and agility. Technological advancements, sustainability initiatives, and digitalization are pivotal in shaping the future of the market, demanding continuous adaptation and strategic innovation from all players.

Industry Developments and Latest Updates:

Hammond Power Solutions Inc. (Canada):

- October 26, 2023: Announced collaboration with Schneider Electric to develop and market integrated medium-voltage dry transformer and switchgear solutions. (Source: Hammond Power Solutions press release)

ABB Ltd. (Switzerland):

- December 12, 2023: Showcased its latest dry transformer technology at the Middle East Electricity exhibition in Dubai. (Source: ABB website)

Siemens AG (Germany):

- November 15, 2023: Launched its new Sicostar CAST dry transformer series for data centers and critical infrastructure. (Source: Siemens website)

General Electric (U.S.):

- October 31, 2023: Unveiled its new GridShieldTM line of low-carbon footprint dry transformers. (Source: GE Renewable Energy website)

Jinpan International Ltd. (China):

- December 5, 2023: Received a large order for dry transformers from a state-owned power utility in China. (Source: Jinpan International website)