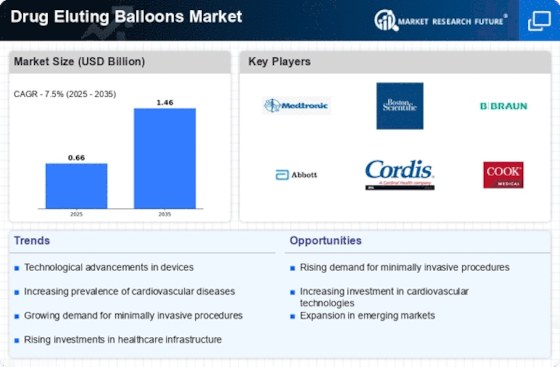

Focus on Minimally Invasive Procedures

The shift towards minimally invasive procedures is significantly influencing the Drug Eluting Balloons Market. Patients and healthcare providers alike are increasingly favoring techniques that reduce recovery time and minimize surgical risks. Drug eluting balloons align perfectly with this trend, as they can be deployed through catheterization, avoiding the need for open surgery. This method not only enhances patient comfort but also leads to shorter hospital stays and quicker return to daily activities. Market analysis suggests that the adoption of minimally invasive techniques is likely to drive the drug eluting balloons market, with projections indicating a potential market expansion of around 15% in the coming years. This growing preference for less invasive options highlights the evolving landscape of cardiovascular treatments and the integral role of drug eluting balloons within it.

Regulatory Approvals and Clinical Evidence

The Drug Eluting Balloons Market is bolstered by the increasing number of regulatory approvals and the accumulation of clinical evidence supporting their use. Regulatory bodies are progressively recognizing the benefits of drug eluting balloons, leading to expedited approvals for new products. This trend is crucial, as it allows manufacturers to bring innovative solutions to market more swiftly. Additionally, a growing body of clinical studies demonstrates the effectiveness and safety of these devices in various patient populations. For instance, recent trials have shown that drug eluting balloons can significantly reduce restenosis rates compared to traditional balloon angioplasty. This accumulation of evidence is likely to enhance physician confidence in prescribing these devices, potentially leading to a market growth rate of around 12% in the next few years. The interplay between regulatory support and clinical validation is vital for the sustained expansion of the Drug Eluting Balloons Market.

Rising Prevalence of Cardiovascular Diseases

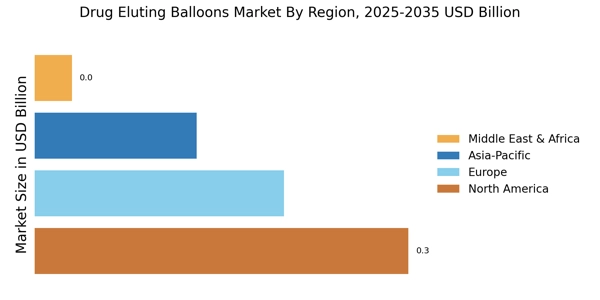

The increasing incidence of cardiovascular diseases is a primary driver for the Drug Eluting Balloons Market. As populations age and lifestyle-related health issues become more prevalent, the demand for effective treatment options is escalating. Data indicates that cardiovascular diseases account for a significant percentage of global mortality, prompting healthcare systems to seek innovative solutions. Drug eluting balloons, which offer targeted drug delivery to arterial lesions, are becoming a preferred choice for treating conditions such as coronary artery disease. The market is expected to witness substantial growth, with estimates suggesting that the demand for drug eluting balloons could increase by over 10% annually in regions with high cardiovascular disease rates. This trend underscores the critical role that drug eluting balloons will play in addressing the healthcare challenges posed by cardiovascular conditions.

Increasing Investment in Healthcare Infrastructure

The Drug Eluting Balloons Market is positively impacted by the rising investment in healthcare infrastructure across various regions. Governments and private entities are recognizing the need to enhance healthcare facilities, particularly in areas with high incidences of cardiovascular diseases. This investment is likely to lead to the establishment of advanced medical centers equipped with the latest technologies, including drug eluting balloons. As healthcare systems evolve, the availability of these devices is expected to increase, thereby driving market growth. Recent reports indicate that healthcare spending is projected to rise by approximately 5% annually, which could translate into greater accessibility to innovative treatments. This trend suggests that the Drug Eluting Balloons Market will benefit from improved healthcare infrastructure, ultimately enhancing patient outcomes and expanding market reach.

Technological Advancements in Drug Eluting Balloons

The Drug Eluting Balloons Market is experiencing a surge in technological advancements that enhance the efficacy and safety of these devices. Innovations such as improved drug formulations and balloon materials are being developed to optimize drug delivery and minimize complications. For instance, the introduction of bioresorbable polymers is gaining traction, as they may reduce the risk of late thrombosis. Furthermore, advancements in balloon catheter designs are likely to improve the precision of deployment, which is crucial for successful outcomes. According to recent data, the market for drug eluting balloons is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next few years, driven by these technological innovations. This trend suggests that ongoing research and development will continue to play a pivotal role in shaping the future of the Drug Eluting Balloons Market.