Public health programs are stressing how important it is to make changes to your lifestyle, such as eating better and exercising, which may help with diabetes management. Governments and health organizations throughout the globe are also making it a priority to ensure that diabetes treatments are inexpensive. To deal with the problems of diabetes care on a worldwide scale, it is important for all parties involved, such as drug companies, healthcare professionals, and legislators, to work together more.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Diabetes Drug Market Drivers

Rising Incidence of Diabetes Globally

The Diabetes Drug Market Industry is significantly driven by the rising incidence of diabetes worldwide. According to the International Diabetes Federation, the prevalence of diabetes is expected to rise to approximately 643 million adults by 2030, reflecting a staggering increase. This surge is attributed to factors like urbanization, unhealthy diets, and sedentary lifestyles, particularly in developing countries. Government initiatives aim to combat this epidemic through improved healthcare infrastructure and awareness campaigns.For instance, many nations are implementing programs targeting early detection and resource allocation to manage diabetes care effectively.

The involvement of organizations such as the World Health Organization (WHO) in monitoring and addressing this healthcare crisis has substantially influenced the demand for diabetes drugs. These dynamics not only drive growth but also indicate a robust market potential as more individuals require medical attention and pharmaceutical intervention.

Advancements in Drug Development

The Diabetes Drug Market Industry is propelled by significant advancements in drug development and Research and Development initiatives. Pharmaceutical companies are increasingly investing in innovative therapies, including glucagon-like peptide-1 receptor agonists and sodium-glucose cotransporter 2 inhibitors, which have shown efficacy in controlling blood sugar levels. According to the Food and Drug Administration, there has been a substantial increase in the number of diabetes drugs receiving approval, with nearly 10 new medications launched within the last three years alone.The advancements aim not only to enhance the effectiveness of diabetes management but also to minimize side effects.

This trend is vital for patient compliance and overall satisfaction, thus expanding the market footprint.

Growing Aging Population

The Diabetes Drug Market Industry growth is further reinforced by the increasing aging population globally. The United Nations reports that by 2050, the number of people aged 60 years and older is expected to reach approximately 2 billion, leading to a higher prevalence of chronic diseases such as diabetes. Aging increases susceptibility to type 2 diabetes, necessitating ongoing medical treatment and pharmaceutical interventions to manage health effectively.

As governments worldwide adapt their healthcare policies to accommodate an older population, there will be a significant rise in diabetes drug prescriptions, creating a lucrative market opportunity for pharmaceutical companies focusing on this demographic.

Diabetes Drug Market Segment Insights

Diabetes Drug Market Drug Class Insights

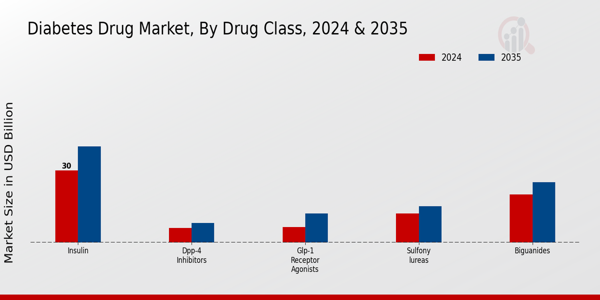

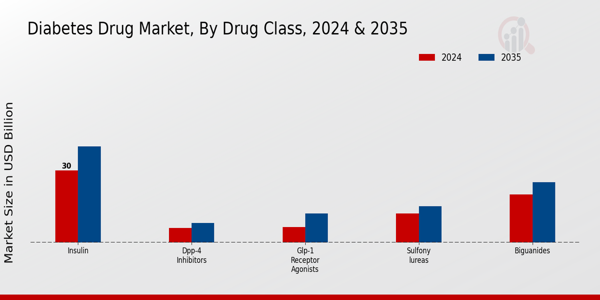

The Diabetes Drug Market is experiencing notable growth with a diversified range of drug classes that cater to the needs of diabetic patients. The Insulin class holds a majority holding within this segment, valued at 30.0 USD Billion in 2024 and expected to rise to 40.0 USD Billion by 2035. This significant valuation reflects insulin's critical role in managing diabetes, as it is essential for type 1 diabetes patients and increasingly prescribed for type 2 diabetes patients to maintain glucose levels.

Sulfonylureas are another important drug class, projected to be valued at 12.0 USD Billion in 2024 and reaching 15.0 USD Billion in 2035. This drug class plays a crucial role as an oral medication by stimulating insulin production in the pancreas, thus demonstrating its significance in daily diabetes management.

Biguanides, valued at 20.0 USD Billion in 2024 with an estimated increase to 25.0 USD Billion in 2035, are also vital in the Diabetes Drug Market, as they work by reducing glucose production in the liver and enhancing insulin sensitivity, making them a primary choice for treating type 2 diabetes. DPP-4 Inhibitors and GLP-1 Receptor Agonists, while relatively smaller in market share, are gradually gaining traction due to their unique mechanisms of action and benefits for patients.

DPP-4 Inhibitors, with a valuation of 6.0 USD Billion in 2024 growing to 8.0 USD Billion by 2035, offer advantages by targeting the incretin hormone to lower blood sugar without causing significant weight gain. In contrast, GLP-1 Receptor Agonists, starting at 6.37 USD Billion in 2024 and expected to expand to 12.0 USD Billion in 2035, are crucial due to their dual action of lowering blood sugar levels and promoting weight loss, which is particularly beneficial for many type 2 diabetes patients facing obesity issues.

Overall, this landscape of drug classes within the Diabetes Drug Market reveals a focused effort towards providing effective treatments tailored to individual needs. With insulin dominating the market, alongside the important contributions made by Sulfonylureas, Biguanides, DPP-4 Inhibitors, and GLP-1 Receptor Agonists, the market continues to evolve driven by growing diabetes prevalence globally. This growth is propelled by increasing awareness, better diagnostic options, and an ongoing commitment to enhance patient outcomes through innovative therapeutics.

As the global population continues to rise and the incidence of diabetes remains a pressing health concern, the Drug Class segment serves as a vital part of the Diabetes Drug Market, demonstrating the ongoing opportunity for growth and development within this essential healthcare sector.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Diabetes Drug Market Administration Route Insights

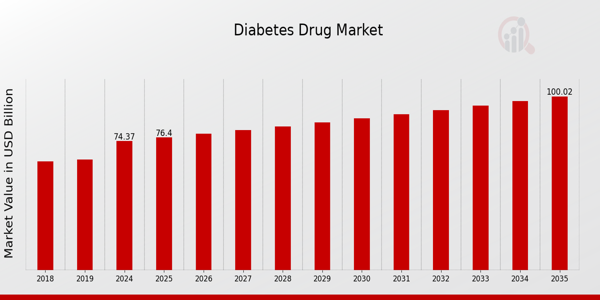

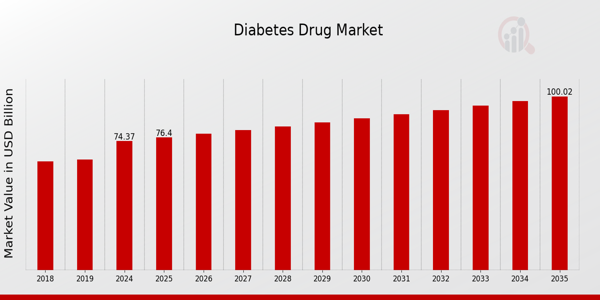

The Diabetes Drug Market, particularly focusing on the Administration Route segment, has shown significant growth with expected revenue reaching 74.37 USD Billion by 2024. This segment is crucial as it influences the delivery methods of diabetes treatments, which greatly impact patient adherence and health outcomes. The market is primarily divided into various routes including Oral, Injectable, Inhalation, and Transdermal. Oral administration remains a dominant choice due to its convenience and wide acceptance among patients.

Leave a Comment