Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure is a pivotal driver for the Disposable Medical Supplies Market. As countries invest in enhancing their healthcare systems, the demand for medical supplies is expected to rise correspondingly. New hospitals, clinics, and healthcare facilities are being established, particularly in emerging markets, which creates a substantial need for disposable medical products. Data suggests that healthcare expenditure is projected to increase, with many regions allocating significant budgets for medical supplies. This expansion not only supports the growth of the Disposable Medical Supplies Market but also encourages innovation and competition among manufacturers, ultimately benefiting healthcare providers and patients.

Growing Awareness of Infection Prevention

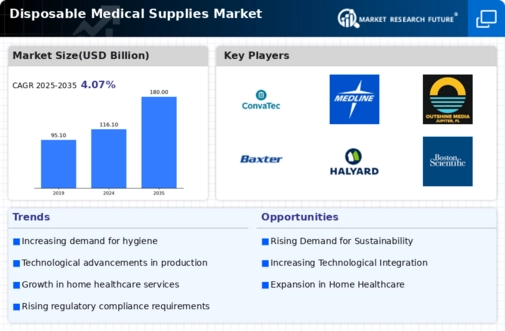

The Disposable Medical Supplies Market is benefiting from a heightened awareness of infection prevention among healthcare providers and patients alike. The emphasis on hygiene and safety in medical settings has led to an increased demand for disposable products that minimize the risk of cross-contamination. Market Research Future indicates that the infection prevention market is expected to grow at a rate of around 7% annually, which directly correlates with the rising use of disposable medical supplies. This trend is particularly relevant in surgical and clinical environments, where the need for sterile and single-use products is paramount. Consequently, the Disposable Medical Supplies Market is likely to see sustained growth as healthcare facilities prioritize infection control measures.

Rising Demand for Home Healthcare Services

The Disposable Medical Supplies Market is experiencing a notable increase in demand for home healthcare services. This trend is driven by an aging population and a growing preference for receiving care in the comfort of one's home. According to recent data, the home healthcare market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 8% in the coming years. As more patients require medical supplies for home use, the Disposable Medical Supplies Market is likely to expand to meet this need. This shift not only enhances patient comfort but also reduces the burden on healthcare facilities, thereby creating a robust market for disposable medical products tailored for home care.

Increased Regulatory Standards and Compliance

The Disposable Medical Supplies Market is significantly influenced by the rise in regulatory standards and compliance requirements. Governments and health organizations are implementing stricter regulations to ensure the safety and efficacy of medical supplies. This trend is particularly evident in the manufacturing and distribution processes of disposable medical products. Compliance with these regulations not only enhances product quality but also fosters consumer trust. As a result, manufacturers are investing in quality assurance and control measures, which may lead to increased operational costs. However, this focus on compliance is likely to drive the growth of the Disposable Medical Supplies Market, as healthcare providers seek reliable and safe products for their patients.

Technological Advancements in Medical Devices

Technological innovations are playing a crucial role in shaping the Disposable Medical Supplies Market. The integration of advanced technologies in medical devices has led to the development of more efficient and user-friendly disposable products. For instance, the introduction of smart medical supplies equipped with sensors and connectivity features is enhancing patient monitoring and care. Market data indicates that the medical device sector is expected to grow at a rate of approximately 5% annually, which directly influences the demand for disposable medical supplies. As healthcare providers increasingly adopt these technologies, the Disposable Medical Supplies Market is poised for growth, driven by the need for innovative and effective medical solutions.

Leave a Comment