Focus on Infection Prevention and Control

The emphasis on infection prevention and control remains a critical driver in the disposable hospital-supplies market. Healthcare facilities are increasingly prioritizing measures to reduce the risk of hospital-acquired infections (HAIs). Disposable products, which are designed for single-use, play a vital role in minimizing the potential for cross-contamination. As hospitals implement stricter infection control protocols, the demand for disposable supplies is likely to rise. This focus on infection prevention is expected to contribute to a market growth rate of approximately 4% annually, as healthcare providers recognize the importance of maintaining a safe environment for patients and staff.

Regulatory Compliance and Safety Standards

Regulatory compliance plays a pivotal role in shaping the disposable hospital-supplies market. Stringent regulations imposed by health authorities necessitate the use of disposable products to ensure patient safety and minimize the risk of cross-contamination. Hospitals are increasingly adopting disposable supplies to adhere to these regulations, which often mandate the use of single-use items in specific procedures. The disposable hospital-supplies market is thus influenced by the need for compliance with safety standards, which can vary by state and facility type. This driver is expected to contribute to a steady growth trajectory, as healthcare providers prioritize adherence to regulations while ensuring patient safety.

Rising Demand for Cost-Effective Solutions

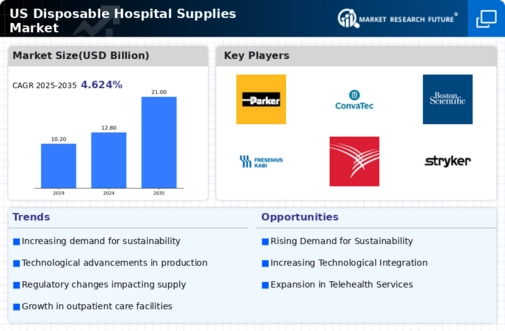

The disposable hospital-supplies market experiences a notable increase in demand for cost-effective solutions. Healthcare facilities are under constant pressure to reduce operational costs while maintaining high standards of care. This trend is particularly evident in the context of budget constraints faced by hospitals and clinics. As a result, the market for disposable supplies, which often offer lower upfront costs compared to reusable alternatives, is expanding. In 2025, the market is projected to reach approximately $10 billion, reflecting a growth rate of around 5% annually. This shift towards disposable products is driven by the need for efficiency and cost savings, making it a critical driver in the disposable hospital-supplies market.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes significantly impact the disposable hospital-supplies market. Advances in materials science and production techniques enable manufacturers to create more efficient, cost-effective, and high-quality disposable products. Innovations such as automated production lines and improved sterilization methods enhance the reliability and safety of disposable supplies. As a result, healthcare providers are increasingly inclined to adopt these advanced products, which can lead to better patient outcomes. The market is likely to benefit from these technological advancements, with an anticipated growth rate of 6% over the next few years, as hospitals seek to leverage improved manufacturing capabilities.

Increased Patient Volume and Healthcare Accessibility

The disposable hospital-supplies market is influenced by the rising patient volume and improved healthcare accessibility across the United States. As more individuals gain access to healthcare services, the demand for medical supplies, including disposable items, is expected to rise. This trend is particularly pronounced in urban areas where healthcare facilities are experiencing higher patient influx. The disposable hospital-supplies market is projected to grow in response to this increased demand, with estimates suggesting a market value of $12 billion by 2026. This driver underscores the importance of disposable supplies in meeting the needs of a growing patient population.