Rising Demand in E-commerce

The Direct Thermal Printer Labels Market is experiencing a notable surge in demand, primarily driven by the rapid expansion of e-commerce. As online shopping continues to grow, businesses require efficient labeling solutions for shipping and inventory management. In 2025, the e-commerce sector is projected to account for a substantial portion of retail sales, necessitating the use of direct thermal labels for their cost-effectiveness and ease of use. These labels eliminate the need for ink or toner, which aligns with the operational efficiencies sought by e-commerce companies. Furthermore, the convenience of printing labels on-demand enhances the overall customer experience, making direct thermal labels an essential component in the logistics of e-commerce operations.

Customization and Personalization Trends

The Direct Thermal Printer Labels Market is witnessing a shift towards customization and personalization, driven by consumer preferences for tailored products. Businesses are increasingly utilizing direct thermal labels to create unique branding experiences and enhance product visibility. In 2025, the market for customized labels is projected to grow by 15%, as companies recognize the value of personalized packaging in attracting customers. Direct thermal printing technology allows for quick adjustments in label design, enabling businesses to respond rapidly to market trends and consumer demands. This flexibility not only improves customer engagement but also fosters brand loyalty, making direct thermal labels a vital tool in modern marketing strategies.

Sustainability and Eco-friendly Practices

The Direct Thermal Printer Labels Market is increasingly influenced by sustainability trends and eco-friendly practices. As businesses become more environmentally conscious, there is a growing preference for labeling solutions that minimize waste and reduce carbon footprints. Direct thermal labels, which do not require ink or toner, align well with these sustainability goals. In 2025, it is anticipated that the demand for eco-friendly labeling solutions will rise by 20%, as companies seek to enhance their corporate social responsibility initiatives. This shift towards sustainable practices is prompting manufacturers to develop direct thermal labels using recyclable materials, further driving their adoption in various sectors, including food and beverage.

Increased Focus on Supply Chain Efficiency

The Direct Thermal Printer Labels Market is significantly influenced by the growing emphasis on supply chain efficiency. Companies are increasingly adopting direct thermal labels to streamline their logistics and inventory processes. The ability to print labels quickly and accurately reduces delays in shipping and enhances tracking capabilities. In 2025, it is estimated that businesses utilizing direct thermal labels will see a reduction in operational costs by up to 15%, as these labels facilitate faster processing times. This trend is particularly evident in sectors such as retail and manufacturing, where efficient supply chain management is critical. As organizations strive to optimize their operations, the demand for direct thermal labels is likely to rise.

Technological Innovations in Labeling Solutions

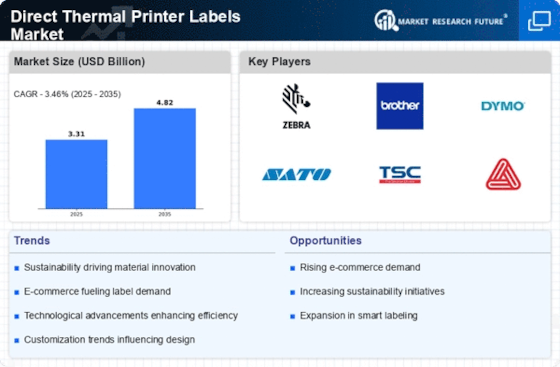

The Direct Thermal Printer Labels Market is benefiting from ongoing technological innovations that enhance labeling solutions. Advancements in printing technology, such as improved thermal print heads and software integration, are making direct thermal labels more versatile and user-friendly. In 2025, the market is expected to witness a growth rate of approximately 8% annually, driven by these innovations. Enhanced features, such as mobile printing capabilities and cloud-based label design software, are appealing to businesses seeking to modernize their labeling processes. These technological improvements not only increase the efficiency of label production but also expand the applications of direct thermal labels across various industries, including healthcare and logistics.