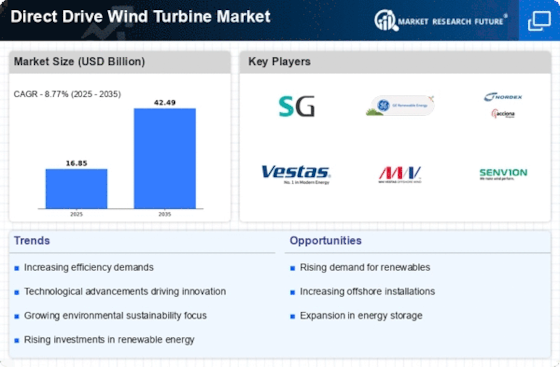

Top Industry Leaders in the Direct Drive Wind Turbine Market

*Disclaimer: List of key companies in no particular order

In the realm of direct drive wind turbines, a captivating spectacle unfolds as the pursuit of heightened efficiency and reduced maintenance instigates a vibrant struggle for supremacy. Seasoned contenders and agile entrants alike find themselves entangled in a dynamic dance, adapting to shifting trends, deploying precise strategies, and contending for a slice of the market pie. This ever-changing landscape, far from stagnant, demands meticulous examination to extract valuable insights into the ongoing tapestry of competitive dynamics.

Prominent Actors and Their Tactical Playbooks:

- Siemens Gamesa: The European behemoth reigns supreme, wielding its extensive experience and global reach to secure preeminent positions in pivotal markets such as Europe and China. Siemens Gamesa concentrates on amplifying its existing offerings, notably the SWT-7.0-154 MW behemoth, while concurrently nurturing its offshore proficiency.

- Vestas: Another European titan, Vestas counters Siemens Gamesa's dominance with a focus on technological ingenuity. Its EnVentus platform, crafted for modularity and scalability, caters to a spectrum of wind regimes. Vestas' assertive foray into emerging markets like India fortifies its competitive edge.

- GE Renewable Energy: The American giant, though trailing behind its European counterparts, is catching up through strategic acquisitions and alliances. GE's Cypress platform flaunts efficient direct drive technology, and its recent collaboration with China's Mingyang broadens its footprint in Asia.

- Goldwind: China's wind energy champion is etching a distinctive niche with its cost-competitive offerings. Leveraging its domestic market presence and vertical integration, Goldwind delivers affordable turbines, particularly appealing to budget-conscious developers.

- Enercon: The German pioneer stays true to its roots, specializing in onshore wind installations and advocating for direct drive technology through its distinctive gearless designs. Enercon's focus on community-owned wind farms and local manufacturing sets it apart.

Market Share Analysis: Beyond Mere Gigawatts: While installed capacity remains a pivotal metric, a comprehensive evaluation of market share demands a multi-dimensional approach. Parameters like revenue distribution, regional supremacy, technological acumen, and service capabilities intricately sketch a nuanced portrait. Scrutinizing project victories, turbine size dispersion, and order backlogs yields profound insights into a company's competitive stance.

Emerging Trends and Ascendant Giants: • Offshore Expansion: The burgeoning offshore wind market beckons with promising prospects. Siemens Gamesa and Vestas ardently develop larger, more potent offshore turbines to harness this potential.

- Floating Offshore Solutions: Novel solutions like floating wind farms take root in deep waters, presenting opportunities for companies like Equinor and Principle Power.

- Digitalization and AI: Embracing digital twins, predictive maintenance, and AI-driven optimization tools is imperative for augmenting efficiency and curbing operational costs. Ørsted leads the charge in this domain.

- Localization and Cost Optimization: Manufacturers tailor their offerings to meet local content requisites and cost expectations, especially in emerging markets. Goldwind's success in China exemplifies this trend.

Competitive Scenario: A Fluid Landscape: The direct drive wind turbine market remains far from saturation. The interplay of technological strides, policy landscapes, and regional dynamics sustains a fierce competition. Alliances, acquisitions, and strategic divestments are poised to reshape the landscape as contenders maneuver for positions. Technological breakthroughs, such as advances in rare earth magnet production, hold the potential to disrupt established players and usher in new contenders.

Looking Ahead: The direct drive wind turbine market stands at the cusp of sustained growth, propelled by the unyielding pursuit of clean energy solutions. Adaptability, innovation, and strategic maneuvering will be pivotal for contenders to secure their foothold in this ever-evolving landscape. Grasping the shifting dynamics of competition, the diverse strategies employed by key players, and the emergent trends shaping the market will be indispensable for navigating the wind-powered future.

Industry Developments and Latest Updates: GE Renewable Energy (U.S.): • Dec 19, 2023: GE Renewable Energy and Ørsted unveil a collaborative pact to develop the Haliade-X 15 MW offshore wind turbine for the Borkum Riffgrund 4 offshore wind farm in Germany. (Source: GE Renewable Energy press release)

Siemens Gamesa Renewable Energy (Germany): • Dec 18, 2023: Siemens Gamesa and Aker Offshore Wind formalize a framework agreement for the supply of SG 11.0-202 DD offshore wind turbines for the Krøytjern Sør I & II offshore wind farm in Norway. (Source: Siemens Gamesa press release)

Goldwind Science & Technology Co. Ltd. (China): • Dec 12, 2023: Goldwind secures a supply agreement with China Huaneng Group for 50 units of GW5X-154 wind turbines for the Zhangjiakou Grassland project. (Source: Goldwind website)

Xiangtan Electric Manufacturing Group (China): Primarily concentrating on the domestic market, Xiangtan Electric is advancing larger direct drive wind turbines for offshore applications.

Emergya Wind Technologies B.V. (The Netherlands): Emergya, a smaller entrant, focuses on niche applications for direct drive wind turbines.

VENSYS Energy AG (Germany): VENSYS, having filed for insolvency in 2019, no longer operates its direct drive wind turbine business.