Diode Bridge Rectifier Market Summary

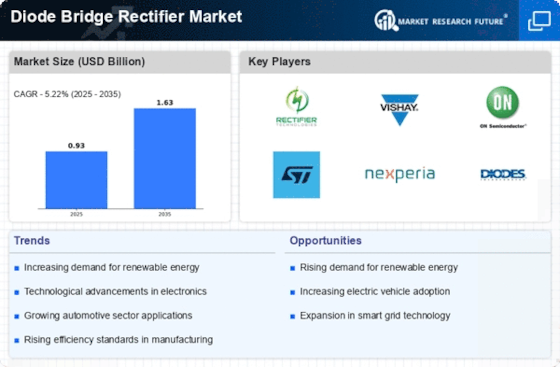

As per Market Research Future analysis, the Diode Bridge Rectifier Market Size was estimated at 0.9319 USD Billion in 2024. The Diode Bridge Rectifier industry is projected to grow from USD 0.9806 Billion in 2025 to USD 1.631 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.22% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Diode Bridge Rectifier Market is poised for growth driven by technological advancements and increasing demand across various sectors.

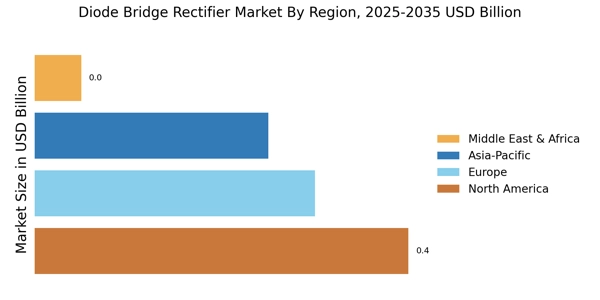

- North America remains the largest market for diode bridge rectifiers, driven by robust industrial applications.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid advancements in consumer electronics.

- The 4-pin segment dominates the market, while the 5-pin segment is witnessing the highest growth rates.

- Technological advancements in power electronics and rising demand from electric vehicles are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 0.9319 (USD Billion) |

| 2035 Market Size | 1.631 (USD Billion) |

| CAGR (2025 - 2035) | 5.22% |

Major Players

Rectifier Technologies (AU), Vishay Intertechnology (US), ON Semiconductor (US), STMicroelectronics (FR), Nexperia (NL), Diodes Incorporated (US), Infineon Technologies (DE), Texas Instruments (US), Toshiba (JP)