Rising Environmental Regulations

Rising environmental regulations are significantly influencing the thyristor rectifier-electric-locomotive market. As governments implement stricter emissions standards, the demand for cleaner transportation options is intensifying. Electric locomotives, which produce zero emissions at the point of use, are becoming increasingly attractive to operators seeking compliance with these regulations. The market is expected to expand as more rail operators transition from diesel to electric systems to meet regulatory requirements. This shift not only supports environmental goals but also enhances the public perception of rail transport, potentially increasing ridership and revenue for operators.

Government Initiatives and Funding

Government initiatives play a crucial role in the thyristor rectifier-electric-locomotive market. Federal and state programs aimed at promoting clean energy and sustainable transportation are likely to provide substantial funding for electric locomotive projects. For instance, the Infrastructure Investment and Jobs Act allocates billions for rail improvements, which may include the integration of thyristor rectifier technology. Such funding not only enhances the financial viability of electric locomotives but also encourages manufacturers to innovate and develop advanced systems. The potential for grants and subsidies could significantly impact the market, making electric locomotives more accessible to operators across the country.

Growing Investment in Rail Infrastructure

Growing investment in rail infrastructure is a key driver for the thyristor rectifier-electric-locomotive market. As the need for modernized transportation networks becomes more pressing, both public and private sectors are channeling funds into rail projects. This investment is likely to facilitate the adoption of electric locomotives, which are more efficient and environmentally friendly. The Federal Railroad Administration has reported an increase in funding for rail improvements, which may include electrification initiatives. Such investments are expected to create a favorable environment for the thyristor rectifier-electric-locomotive market, promoting the development and deployment of advanced electric locomotives.

Technological Innovations in Power Electronics

Technological innovations in power electronics are transforming the thyristor rectifier-electric-locomotive market. Advances in semiconductor technology, particularly in thyristor devices, are enhancing the performance and reliability of electric locomotives. These innovations lead to improved energy conversion efficiency and reduced operational costs. The market is witnessing a shift towards more compact and efficient designs, which could potentially lower maintenance expenses and increase the lifespan of locomotives. As manufacturers continue to invest in research and development, the thyristor rectifier-electric-locomotive market is likely to benefit from these advancements, fostering a competitive landscape.

Increasing Demand for Efficient Transportation Solutions

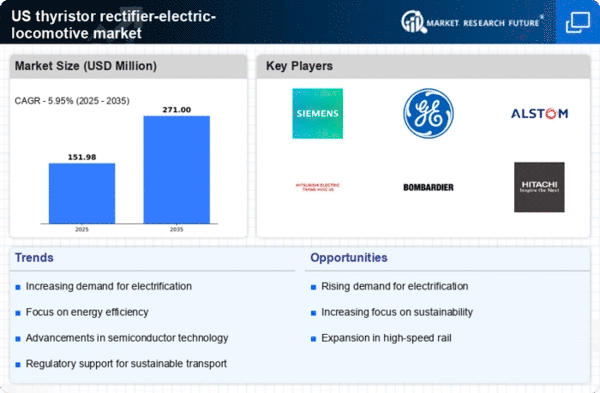

the thyristor rectifier-electric-locomotive market is seeing increased demand for efficient transportation solutions.. As urbanization accelerates, cities are seeking to enhance their public transport systems. Electric locomotives, powered by thyristor rectifiers, offer a cleaner alternative to traditional diesel engines, aligning with environmental regulations. The market is projected to grow at a CAGR of approximately 6% over the next five years, driven by the need for reduced emissions and improved energy efficiency. This trend indicates a shift towards electrification in rail transport, which is likely to bolster the thyristor rectifier-electric-locomotive market. Furthermore, investments in rail infrastructure are expected to increase, further supporting the adoption of electric locomotives.