Cost Reduction and Resource Optimization

The Digital Process Automation Market is significantly influenced by the need for cost reduction and resource optimization. Organizations are under constant pressure to minimize expenses while maximizing output, and automation presents a viable solution. By automating routine tasks, companies can reallocate human resources to more strategic initiatives, thereby enhancing overall productivity. Data suggests that businesses that adopt digital process automation can achieve a 20 to 30% reduction in operational costs. This financial incentive is compelling organizations to explore automation technologies as a means to achieve sustainable growth. Furthermore, as companies seek to optimize their resource allocation, the role of digital process automation in driving efficiency and cost-effectiveness is becoming increasingly critical. This trend is likely to continue as organizations strive to remain competitive in a rapidly evolving market.

Growing Focus on Customer-Centric Solutions

In the Digital Process Automation Market, there is a pronounced shift towards customer-centric solutions as businesses aim to enhance customer experience. Organizations are increasingly recognizing that automating customer interactions can lead to improved satisfaction and loyalty. By streamlining processes such as customer service and support, companies can respond more quickly to customer inquiries and issues. Recent findings suggest that businesses that implement customer-focused automation strategies can see a 25% increase in customer satisfaction scores. This focus on the customer experience is driving organizations to invest in digital process automation technologies that facilitate personalized interactions and efficient service delivery. As customer expectations continue to rise, the demand for automation solutions that prioritize customer engagement is likely to grow.

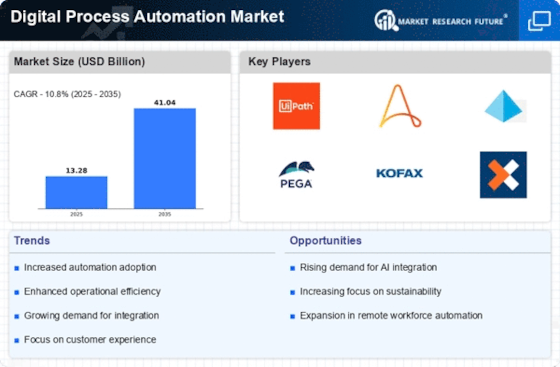

Increased Demand for Operational Efficiency

The Digital Process Automation Market is experiencing a surge in demand for operational efficiency as organizations strive to streamline their processes. Companies are increasingly recognizing that automating repetitive tasks can lead to significant time and cost savings. According to recent data, businesses that implement digital process automation can reduce operational costs by up to 30%. This drive towards efficiency is not merely a trend; it is becoming a necessity for survival in a competitive landscape. As organizations seek to enhance productivity and reduce human error, the adoption of automation technologies is likely to accelerate. This shift is indicative of a broader movement towards digital transformation, where companies are leveraging technology to optimize their workflows and improve overall performance.

Advancements in Technology and AI Integration

The Digital Process Automation Market is being propelled by rapid advancements in technology, particularly in artificial intelligence and machine learning. These technologies are enabling organizations to automate complex processes that were previously deemed too intricate for automation. The integration of AI into digital process automation allows for enhanced decision-making capabilities and predictive analytics, which can significantly improve operational outcomes. Data indicates that companies leveraging AI-driven automation can achieve up to a 50% increase in process efficiency. As technology continues to evolve, the potential for more sophisticated automation solutions will likely expand, attracting more businesses to invest in digital process automation. This trend reflects a broader shift towards intelligent automation, where organizations are not just automating tasks but are also enhancing their strategic capabilities.

Rising Need for Compliance and Risk Management

In the context of the Digital Process Automation Market, the increasing regulatory landscape is compelling organizations to adopt automated solutions for compliance and risk management. Companies are facing heightened scrutiny from regulatory bodies, necessitating the implementation of robust compliance frameworks. Automation tools can facilitate real-time monitoring and reporting, thereby reducing the risk of non-compliance. Recent statistics suggest that organizations utilizing digital process automation for compliance purposes have seen a 40% decrease in compliance-related incidents. This trend underscores the importance of integrating automation into compliance strategies, as it not only mitigates risks but also enhances operational transparency. As regulations continue to evolve, the demand for automated compliance solutions is expected to grow, further propelling the digital process automation market.