Growth of the Packaging Industry

The Digital Ink Market is closely linked to the expansion of the packaging sector, which is currently undergoing a transformation driven by consumer preferences for personalized and sustainable packaging solutions. The rise in e-commerce and online shopping has further fueled this growth, as brands seek to differentiate their products through innovative packaging designs. Recent statistics suggest that The Digital Ink Market is expected to reach a valuation of over 1 trillion dollars by 2026, with digital printing playing a crucial role in this evolution. This growth presents significant opportunities for digital ink manufacturers, as they cater to the increasing demand for high-quality, customizable packaging solutions. Consequently, the Digital Ink Market is poised for substantial growth as it aligns with the packaging industry's evolving needs.

Technological Innovations in Printing

Technological advancements play a pivotal role in shaping the Digital Ink Market. Innovations such as improved ink formulations, enhanced printing techniques, and the integration of digital technologies are driving market growth. For instance, the introduction of high-speed inkjet printers has significantly increased production efficiency, allowing for faster turnaround times and reduced operational costs. Furthermore, advancements in digital printing technology enable the production of high-quality prints with vibrant colors and intricate designs. As a result, the market is witnessing a shift towards digital printing solutions, which are expected to account for a substantial share of the overall printing market. This trend indicates a promising future for the Digital Ink Market, as businesses increasingly adopt these technologies to meet evolving consumer demands.

Rising Demand for Eco-Friendly Solutions

The Digital Ink Market is experiencing a notable shift towards eco-friendly solutions, driven by increasing consumer awareness regarding environmental sustainability. As industries seek to reduce their carbon footprint, the demand for sustainable digital inks has surged. This trend is reflected in the growing adoption of bio-based and water-based inks, which are perceived as less harmful to the environment. According to recent data, the market for eco-friendly digital inks is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This shift not only aligns with global sustainability goals but also encourages manufacturers to innovate and develop greener alternatives, thereby enhancing their competitive edge in the Digital Ink Market.

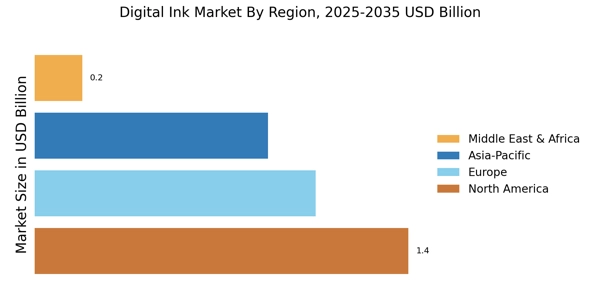

Emerging Markets and Economic Development

The Digital Ink Market is experiencing growth in emerging markets, where economic development is driving increased investments in printing technologies. As countries develop their infrastructure and manufacturing capabilities, the demand for digital inks is expected to rise. This trend is particularly evident in regions where urbanization and industrialization are accelerating, leading to a greater need for efficient printing solutions. Market analysts project that the demand for digital inks in these regions could grow by over 15% in the coming years, as businesses seek to capitalize on new opportunities. This expansion in emerging markets presents a significant opportunity for stakeholders in the Digital Ink Market, as they can leverage these developments to enhance their market presence and drive innovation.

Increased Adoption of Digital Printing Technologies

The Digital Ink Market is witnessing a surge in the adoption of digital printing technologies across various sectors, including textiles, signage, and commercial printing. This trend is largely attributed to the advantages offered by digital printing, such as reduced setup times, lower waste, and the ability to produce short runs economically. As businesses strive for greater efficiency and flexibility, the shift from traditional printing methods to digital solutions is becoming more pronounced. Market data indicates that the digital printing segment is expected to grow at a rate of approximately 10% annually, reflecting the increasing preference for on-demand printing capabilities. This transition not only enhances operational efficiency but also positions the Digital Ink Market favorably for future growth.