Technological Innovations

Technological innovations play a pivotal role in shaping the Ink Resins Market. Advancements in formulation technologies have led to the development of high-performance resins that enhance print quality and durability. For instance, the introduction of water-based and UV-curable resins has transformed the market landscape. In 2025, the market for UV-curable ink resins is expected to account for over 30% of total sales, driven by their rapid curing capabilities and reduced environmental impact. These innovations not only improve product performance but also cater to the evolving needs of end-users, thereby propelling the Ink Resins Market forward.

Growth in Packaging Sector

The Ink Resins Market is significantly bolstered by the expansion of the packaging sector. As consumer preferences shift towards attractive and functional packaging, the demand for high-quality inks and resins surges. In 2025, the packaging segment is anticipated to represent nearly 50% of the total ink resins market share. This growth is fueled by the increasing use of flexible packaging materials, which require specialized ink formulations. Consequently, manufacturers are focusing on developing resins that offer superior adhesion and printability, thereby enhancing the overall quality of packaging solutions in the Ink Resins Market.

Sustainability Initiatives

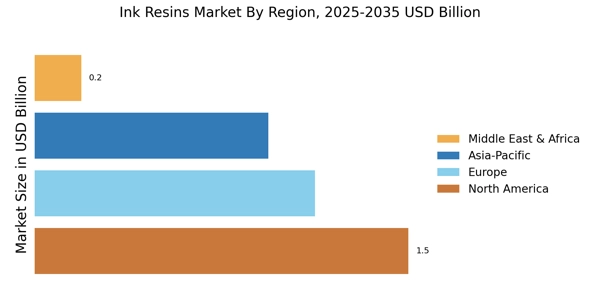

The Ink Resins Market is increasingly influenced by sustainability initiatives. As environmental concerns rise, manufacturers are compelled to adopt eco-friendly practices. This shift is evident in the growing demand for bio-based and recyclable ink resins. In 2025, the market for sustainable ink resins is projected to reach approximately 1.5 billion USD, reflecting a compound annual growth rate of around 8%. Companies are investing in research and development to create resins that minimize environmental impact while maintaining performance. This trend not only aligns with consumer preferences but also meets regulatory requirements, thereby driving growth in the Ink Resins Market.

Rising Demand for Digital Printing

The Ink Resins Market is experiencing a notable shift towards digital printing technologies. As businesses seek faster and more efficient printing solutions, the demand for digital inks and resins is on the rise. In 2025, the digital printing segment is projected to grow at a rate of 10%, driven by advancements in printing technology and the need for customization. This trend encourages manufacturers to innovate and develop specialized resins that cater to digital applications, thereby expanding their product offerings. The increasing adoption of digital printing is likely to reshape the Ink Resins Market, presenting new opportunities for growth.

Regulatory Compliance and Standards

Regulatory compliance and standards are becoming increasingly critical in the Ink Resins Market. Governments worldwide are implementing stringent regulations regarding the use of hazardous materials in inks and coatings. This has prompted manufacturers to reformulate their products to meet safety and environmental standards. In 2025, it is estimated that compliance-related costs will account for approximately 15% of total production expenses in the ink resins sector. As a result, companies are investing in cleaner technologies and alternative materials, which not only ensure compliance but also enhance their market competitiveness. This focus on regulatory adherence is likely to drive innovation and growth within the Ink Resins Market.