Top Industry Leaders in the Digital Identity Market

The Competitive Landscape of the Digital Identity Market: A Bird's Eye View

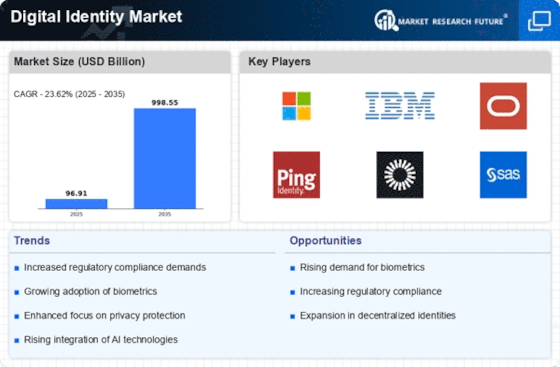

The digital identity market is experiencing explosive growth, fueled by increasing reliance on online services, security concerns, and government initiatives. This dynamic landscape is teeming with established players, nimble startups, and a diverse range of solutions vying for market share. Navigating this terrain requires a comprehensive understanding of the key players, their strategies, and the factors shaping the competitive landscape.

Key Players and Their Strategies:

-

NEC (Japan)

-

Samsung SDS (South Korea)

-

Thales (France)

-

Telus (Canada)

-

IDEMIA (France)

-

GBG (UK)

-

Tessi (France)

-

Daon (US)

-

ForgeRock (US)

-

ImageWare (US)

-

Jumio (US)

-

iProov (UK)

-

ID R&D (US)

-

Refinitiv (UK)

-

OneSpan (US)

-

Smartmatic (UK)

-

Freja EID Group (Sweden)

-

Vintegris (Spain)

-

AU10TIX (Israel)

-

Signicat (Norway)

-

Duo Security (US)

-

Syntizen (India)

-

Hashcash Consultant (US)

-

Good Digital Identity (Czech Republic)

Strategies for Success:

-

Comprehensive Solutions: Offering a suite of integrated identity solutions encompassing authentication, authorization, and privacy management is crucial for catering to diverse customer needs.

-

Focus on User Experience: A seamless and secure user experience is paramount for adoption. Players are prioritizing simplicity, intuitive interfaces, and multi-factor authentication options.

-

Compliance and Security: Stringent data privacy regulations and cybersecurity threats demand robust compliance measures and secure data management practices.

-

Partnerships and Collaborations: Strategic partnerships with technology providers, government agencies, and industry players can accelerate market reach and adoption.

-

Open Standards and Interoperability: Embracing open standards and fostering interoperability across platforms ensures wider ecosystem adoption and scalability.

Factors for Market Share Analysis:

-

Product Portfolio Breadth and Depth: The extent and sophistication of offered solutions significantly impact market share.

-

Customer Base and Target Market: Focusing on specific industry verticals or catering to diverse customer segments can drive share growth.

-

Geographic Reach and Expansion: Global presence and ability to adapt to regional regulations influence market standing.

-

Brand Reputation and Trust: Established brands and those demonstrating data privacy commitment hold an edge.

-

Innovation and Technological Advancements: Continuous investment in R&D and adoption of cutting-edge technologies like blockchain and AI fuel market leadership.

New and Emerging Companies:

The influx of innovative startups like Bloom, Evernym, and Sovrin is reshaping the landscape. These companies are pioneering decentralized identity solutions, offering greater user control and data ownership.

Current Investment Trends:

-

Venture capital (VC) investments in digital identity startups are surging, surpassing $4 billion in 2022.

-

Focus areas include decentralized identity, biometrics, and self-sovereign identity management.

-

Large-scale acquisitions by established players like Microsoft's purchase of Oribi and Okta's acquisition of Auth0 highlight the strategic importance of the market.

Latest Company Updates:

November 2023-Hungary has scheduled the launch of a biometric digital identity system for late 2024. The digital ID in Hungary will enable citizens to verify their identity, make payments to the government, complete administrative tasks, and access public services by tapping a mobile app. Online identification will be furnished through a state electronic identification service by matching users' facial images against a government database. Digital identification will be paired with electronic signatures. Fingerprint biometrics will also be gathered from citizens when they enrol.

November 2023- Resecurity introduced a Digital Identity Protection service to protect Consumers and Companies in India from Dark Web Activity. Resecurity is taking action to safeguard the digital realm with their identity theft protection offerings. Resecurity is a premier cybersecurity firm seeking to provide an integrated platform for endpoint security, risk management, and threat intelligence for large corporations and public agencies globally. This cybersecurity organization makes available a unified system for endpoint defense, risk management, and threat intelligence. Their concentration reaches large enterprises and government bodies worldwide, guaranteeing a comprehensive tactic to digital safety.

October 2023- Lloyds Banking Group has introduced a digital identity service in collaboration with a technology startup it invested in during the current year. The application, which is free of cost and accessible to all residents of the UK, enables users to prove their identity through a mobile phone. The app allows users to give information to identify themselves to companies via a reusable digital ID on their mobile device, eliminating the need to provide physical documents. This also implies that only certain details are provided, decreasing the risk of identity theft.