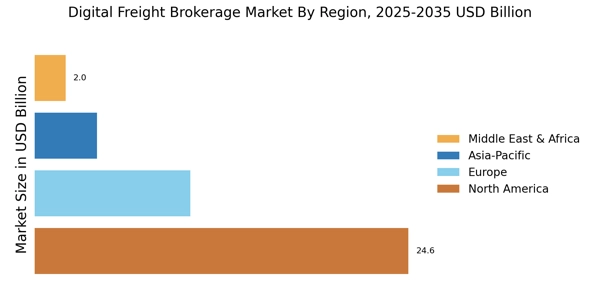

North America : Digital Innovation Leader

North America is the largest market for digital freight brokerage, holding approximately 60% of the global market share. The region's growth is driven by technological advancements, increasing demand for efficient logistics solutions, and supportive regulatory frameworks. The rise of e-commerce and the need for real-time tracking are significant demand trends fueling this growth. Regulatory catalysts, such as the Federal Motor Carrier Safety Administration's initiatives, further enhance market dynamics.

The competitive landscape in North America is robust, with key players like Uber Freight, Convoy, and Transfix leading the charge. The presence of these companies fosters innovation and competition, driving improvements in service delivery and customer satisfaction. The U.S. remains the dominant player, while Canada is emerging as a significant market, contributing to the overall growth of the region.

Europe : Emerging Digital Hub

Europe is witnessing a rapid transformation in the digital freight brokerage market, holding around 25% of the global market share. The growth is propelled by increasing logistics costs, a push for sustainability, and the adoption of digital technologies. Regulatory frameworks, such as the European Union's Mobility Package, are catalyzing this shift by promoting fair competition and innovation in the logistics sector. The demand for integrated logistics solutions is also on the rise, further driving market expansion.

Leading countries in this region include Germany, the UK, and France, which are at the forefront of adopting digital freight solutions. The competitive landscape features both established players and startups, fostering a dynamic environment. Companies like Freightos and Project44 are making significant strides, enhancing operational efficiencies and customer experiences. The presence of these key players is crucial for the region's growth trajectory.

Asia-Pacific : Rapid Growth Region

Asia-Pacific is emerging as a significant player in the digital freight brokerage market, accounting for approximately 10% of the global market share. The region's growth is driven by rapid urbanization, increasing trade activities, and the adoption of advanced technologies. Government initiatives aimed at improving infrastructure and logistics efficiency are also key growth drivers. Countries like China and India are leading this transformation, with a growing emphasis on digital solutions in logistics and transportation.

The competitive landscape in Asia-Pacific is diverse, with a mix of local and international players. Key companies are leveraging technology to enhance service offerings and operational efficiencies. The presence of startups focusing on innovative solutions is also notable, contributing to a vibrant market environment. As the region continues to develop, the digital freight brokerage market is expected to expand significantly, driven by both demand and technological advancements.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the digital freight brokerage market, holding about 5% of the global market share. The growth is primarily driven by increasing trade activities, investments in logistics infrastructure, and the adoption of digital technologies. Government initiatives aimed at enhancing trade facilitation and logistics efficiency are also contributing to market growth. Countries like South Africa and the UAE are leading the charge, focusing on improving their logistics capabilities.

The competitive landscape in this region is evolving, with both local and international players entering the market. Key players are focusing on leveraging technology to streamline operations and enhance customer experiences. The presence of innovative startups is also notable, contributing to the overall growth of the digital freight brokerage market. As the region continues to develop, significant opportunities for growth and expansion are anticipated.