Rising Prevalence of Diabetes

The increasing prevalence of diabetes worldwide is a primary driver for the Diabetes Care Drugs and Devices Market. According to the World Health Organization, the number of individuals diagnosed with diabetes has surged significantly, with estimates suggesting that over 400 million people are currently living with the condition. This alarming trend necessitates a robust demand for effective diabetes care solutions, including medications and monitoring devices. As the population ages and lifestyle-related factors contribute to the rise in diabetes cases, the market for diabetes care products is expected to expand. The growing awareness of diabetes management and the importance of early intervention further fuels this demand, indicating a sustained growth trajectory for the Diabetes Care Drugs and Devices Market.

Innovations in Drug Development

Innovations in drug development are transforming the Diabetes Care Drugs and Devices Market. Recent advancements in pharmacotherapy, including the introduction of novel classes of medications such as GLP-1 receptor agonists and SGLT2 inhibitors, have shown promising results in managing blood glucose levels and reducing cardiovascular risks. These innovations not only enhance treatment efficacy but also improve patient adherence to therapy. The market is witnessing a shift towards combination therapies that offer multifaceted benefits, thereby expanding treatment options for patients. Furthermore, the increasing investment in research and development by pharmaceutical companies is likely to yield new therapies, which could significantly impact the Diabetes Care Drugs and Devices Market in the coming years.

Increased Focus on Preventive Healthcare

An increased focus on preventive healthcare is significantly influencing the Diabetes Care Drugs and Devices Market. Governments and health organizations are prioritizing diabetes prevention strategies, recognizing the long-term benefits of early intervention. This shift towards preventive measures includes promoting healthy lifestyles, regular screenings, and access to diabetes education. As a result, there is a growing emphasis on products that facilitate early detection and management of diabetes. The market is likely to see an uptick in demand for devices that support preventive care, such as blood glucose monitors and educational tools. This trend not only enhances patient outcomes but also reduces the overall healthcare burden associated with diabetes, thereby driving growth in the Diabetes Care Drugs and Devices Market.

Growing Demand for Continuous Glucose Monitoring

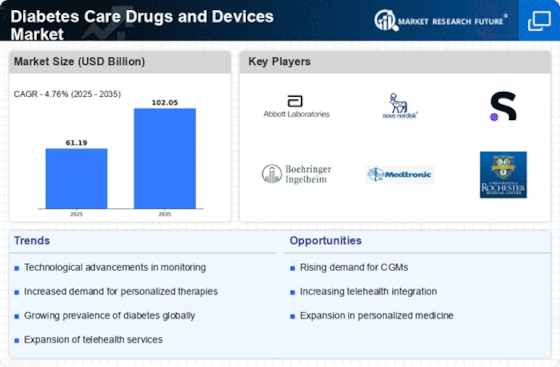

The growing demand for continuous glucose monitoring (CGM) systems is reshaping the Diabetes Care Drugs and Devices Market. These advanced devices provide real-time glucose readings, enabling patients to manage their diabetes more effectively. The market for CGM systems is projected to grow at a compound annual growth rate of over 20% in the next few years, driven by technological advancements and increasing awareness of diabetes management. Patients and healthcare providers are increasingly recognizing the benefits of CGM, including improved glycemic control and reduced risk of hypoglycemia. As more individuals seek personalized and proactive diabetes management solutions, the CGM segment is expected to play a pivotal role in the overall growth of the Diabetes Care Drugs and Devices Market.

Integration of Artificial Intelligence in Diabetes Management

The integration of artificial intelligence (AI) in diabetes management is emerging as a transformative driver for the Diabetes Care Drugs and Devices Market. AI technologies are being utilized to analyze patient data, predict glucose fluctuations, and personalize treatment plans. This innovative approach enhances the accuracy of diabetes management and empowers patients to make informed decisions regarding their health. The market is witnessing the development of AI-driven applications and devices that offer tailored recommendations, thereby improving patient engagement and adherence to treatment. As healthcare providers increasingly adopt AI solutions, the Diabetes Care Drugs and Devices Market is poised for substantial growth, reflecting the potential of technology to revolutionize diabetes care.

Leave a Comment