Rising Prevalence of Diabetes

The increasing incidence of diabetes worldwide is a primary driver for the Diabetes Devices Market. According to recent statistics, the number of individuals diagnosed with diabetes has surged, with estimates suggesting that over 500 million people are currently living with the condition. This alarming trend necessitates the adoption of advanced diabetes management devices, including continuous glucose monitors and insulin pumps. As the prevalence of diabetes escalates, healthcare systems are compelled to invest in innovative solutions to enhance patient outcomes. Consequently, the demand for diabetes devices is expected to grow, as patients seek effective tools to manage their condition and healthcare providers aim to improve care delivery.

Government Initiatives and Funding

Government initiatives aimed at combating diabetes are influencing the Diabetes Devices Market positively. Various countries have implemented programs to promote diabetes awareness, prevention, and management. These initiatives often include funding for research and development of diabetes devices, as well as subsidies for patients to access necessary technologies. For example, some governments have introduced reimbursement policies for continuous glucose monitoring systems, making them more accessible to patients. Such supportive measures are expected to stimulate market growth, as they encourage innovation and increase the availability of advanced diabetes management tools.

Integration of Telehealth Services

The integration of telehealth services into diabetes management is emerging as a significant driver for the Diabetes Devices Market. Telehealth platforms facilitate remote monitoring and consultations, allowing healthcare providers to engage with patients more effectively. This trend is particularly beneficial for individuals with diabetes, as it enables timely interventions and personalized care plans. The market for telehealth services is expected to expand, with projections indicating a growth rate of approximately 25% annually. As patients increasingly embrace digital health solutions, the demand for compatible diabetes devices that can seamlessly integrate with telehealth platforms is likely to rise, further propelling the market.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is becoming a pivotal driver in the Diabetes Devices Market. Patients are increasingly seeking tailored treatment options that cater to their unique health profiles. This trend is reflected in the rising demand for devices that offer personalized insights and recommendations based on individual glucose patterns. The market for personalized diabetes devices is anticipated to grow significantly, with estimates suggesting a potential increase of over 15% in the next few years. As healthcare providers focus on delivering customized care, the development of devices that integrate personalized data analytics will likely become a key factor in enhancing patient engagement and improving health outcomes.

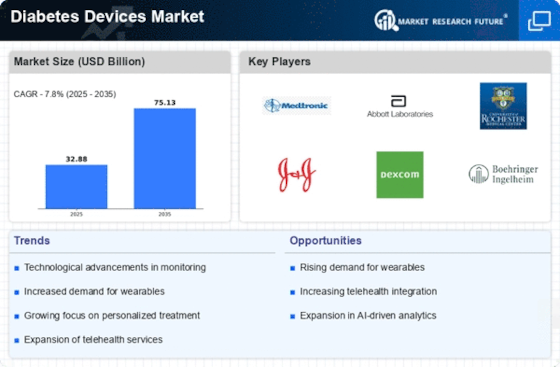

Technological Innovations in Diabetes Management

Technological advancements play a crucial role in shaping the Diabetes Devices Market. Innovations such as artificial intelligence, machine learning, and advanced sensor technologies are revolutionizing diabetes management. For instance, the development of smart insulin pens and automated insulin delivery systems has transformed how patients manage their blood glucose levels. The market for diabetes devices is projected to witness substantial growth, with estimates indicating a compound annual growth rate of over 10% in the coming years. These innovations not only enhance the accuracy of glucose monitoring but also improve patient adherence to treatment regimens, thereby driving the demand for sophisticated diabetes management solutions.