Rising Awareness of Oral Health

The increasing awareness of oral health among the UK population is driving growth in the dental radiology-imaging-devices market. As individuals become more informed about the importance of regular dental check-ups and preventive care, the demand for advanced imaging technologies rises. This trend is reflected in the growing number of dental practices adopting digital radiography systems, which enhance diagnostic accuracy and patient outcomes. According to recent data, the adoption of digital imaging technologies has increased by approximately 30% in the last five years. This heightened awareness not only encourages patients to seek dental care but also compels practitioners to invest in state-of-the-art imaging devices, thereby propelling the market forward.

Government Initiatives and Funding

Government initiatives aimed at improving dental health services in the UK are significantly impacting the dental radiology-imaging-devices market. Funding programs and public health campaigns designed to promote preventive dental care are encouraging practices to upgrade their imaging technologies. For instance, recent government reports indicate an increase in funding for dental practices that adopt modern imaging solutions, which can lead to better patient outcomes. This financial support not only facilitates the acquisition of advanced radiology devices but also fosters a culture of innovation within the dental sector. Consequently, the dental radiology-imaging-devices market is likely to experience sustained growth as practices respond to these initiatives.

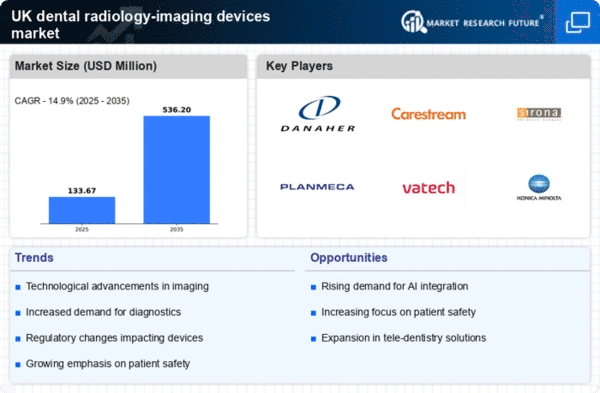

Competitive Landscape and Market Expansion

The competitive landscape of the dental radiology-imaging-devices market is evolving, with numerous players striving to innovate and expand their product offerings. Companies are increasingly focusing on developing user-friendly, cost-effective imaging solutions that meet the diverse needs of dental practitioners. This competitive environment is fostering rapid advancements in technology, as manufacturers seek to differentiate their products. Recent market analyses indicate that the introduction of portable and compact imaging devices has gained traction, appealing to a broader range of dental practices. As competition intensifies, the dental radiology-imaging-devices market is poised for expansion, with new entrants and established firms alike contributing to its growth.

Aging Population and Increased Dental Needs

The aging population in the UK is contributing to a heightened demand for dental services, thereby influencing the dental radiology-imaging-devices market. As individuals age, they often require more comprehensive dental care, including diagnostic imaging for conditions such as periodontal disease and oral cancers. The demographic shift indicates that by 2030, approximately 20% of the UK population will be over 65 years old, leading to an increased need for advanced imaging technologies. This trend suggests that dental practices will need to invest in modern radiology devices to cater to the specific needs of older patients, thereby driving market growth.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices is a key driver of the dental radiology-imaging-devices market. Innovations such as 3D imaging, cone beam computed tomography (CBCT), and artificial intelligence (AI) are transforming diagnostic capabilities. These technologies allow for more precise imaging, which is crucial for treatment planning and patient management. The market has seen a notable increase in the adoption of these technologies, with a reported growth rate of 25% in the last two years. As dental professionals seek to enhance their diagnostic tools, the demand for sophisticated imaging devices continues to rise, indicating a robust future for the dental radiology-imaging-devices market.