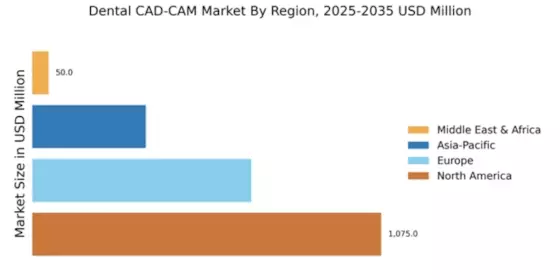

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Dental CAD-CAM market, holding a significant share of $1075.0M in 2025. The region's growth is driven by increasing dental procedures, technological advancements, and a rising demand for cosmetic dentistry. Regulatory support and favorable reimbursement policies further catalyze market expansion, making it a hub for innovation in dental technologies. The competitive landscape is robust, with key players like Sirona Dental Systems, 3M Company, and Dentsply Sirona leading the charge. The U.S. remains the largest market, supported by a high adoption rate of CAD-CAM systems among dental professionals. The presence of advanced research institutions and a strong focus on R&D contribute to the region's dominance, ensuring continuous growth and innovation in the sector.

Europe : Emerging Market with Growth Potential

Europe's Dental CAD-CAM market is projected to reach $675.0M by 2025, driven by increasing awareness of dental aesthetics and technological advancements. The region benefits from stringent regulations that ensure high-quality standards in dental products, fostering consumer trust. Additionally, the rise in dental tourism and a growing elderly population are significant demand drivers, contributing to market growth. Leading countries such as Germany, France, and the UK are at the forefront of this expansion, with a competitive landscape featuring companies like Dentsply Sirona and Exocad. The presence of innovative startups and established firms enhances the market's dynamism. As the region embraces digital dentistry, the integration of CAD-CAM technologies is expected to accelerate, positioning Europe as a key player in the global market.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific Dental CAD-CAM market is anticipated to grow to $350.0M by 2025, fueled by rising disposable incomes and an increasing focus on dental health. The region is witnessing a surge in dental clinics adopting advanced technologies, driven by a growing awareness of oral hygiene and aesthetic dentistry. Government initiatives promoting dental care further support market growth, creating a favorable environment for CAD-CAM adoption. Countries like China, Japan, and India are leading the charge, with a competitive landscape that includes both local and international players. The presence of companies such as Align Technology and Planmeca Oy highlights the region's potential. As the market matures, the integration of digital solutions in dental practices is expected to enhance service delivery and patient outcomes, driving further growth in the sector.

Middle East and Africa : Untapped Market with Opportunities

The Middle East and Africa Dental CAD-CAM market is projected to reach $50.0M by 2025, representing a nascent yet promising segment. The growth is driven by increasing urbanization, rising healthcare expenditure, and a growing awareness of dental aesthetics. Regulatory frameworks are gradually evolving to support the adoption of advanced dental technologies, creating opportunities for market players. Countries like South Africa and the UAE are emerging as key markets, with a competitive landscape that includes both local and international firms. The presence of companies such as Dental Wings and Zirkonzahn indicates a growing interest in CAD-CAM solutions. As the region continues to develop its healthcare infrastructure, the demand for innovative dental solutions is expected to rise, paving the way for future growth in the CAD-CAM market.