Surge in Dental Tourism

The rise of dental tourism is emerging as a notable driver for the Dental Bone Graft Substitutes Market. Patients are increasingly traveling abroad for dental procedures, often seeking cost-effective solutions without compromising quality. This trend has led to a surge in demand for dental services, including bone grafting, in various regions known for their dental care facilities. Countries that offer competitive pricing and high-quality dental services are witnessing an influx of international patients, which in turn stimulates the need for dental bone graft substitutes. Market analysis suggests that dental tourism could contribute to a market growth rate of approximately 12% over the next few years. As dental practices cater to a diverse clientele, the Dental Bone Graft Substitutes Market is poised to expand in response to this growing phenomenon.

Rising Demand for Dental Implants

The increasing prevalence of dental issues, such as tooth loss and periodontal diseases, drives the demand for dental implants. As more patients seek restorative dental procedures, the Dental Bone Graft Substitutes Market experiences a corresponding rise in the need for bone grafting materials. According to recent data, the dental implant market is projected to grow significantly, with a compound annual growth rate (CAGR) of approximately 10% over the next few years. This growth is likely to bolster the demand for dental bone graft substitutes, as these materials are essential for successful implant integration and overall treatment outcomes. Consequently, the expansion of the dental implant sector directly influences the Dental Bone Graft Substitutes Market, creating opportunities for manufacturers and suppliers to innovate and meet the evolving needs of dental professionals.

Increased Focus on Aesthetic Dentistry

The growing emphasis on aesthetic dentistry is significantly influencing the Dental Bone Graft Substitutes Market. Patients are increasingly seeking dental procedures that not only restore function but also enhance appearance. This trend has led to a rise in complex dental surgeries, including those requiring bone grafting to support implants and other restorative work. As aesthetic considerations become paramount, the demand for high-quality bone graft substitutes that facilitate these procedures is likely to increase. Market projections indicate that the aesthetic dentistry segment could see a growth rate of around 14% in the coming years. This shift towards aesthetic solutions underscores the critical role of dental bone graft substitutes in achieving desired outcomes, thereby driving the market forward.

Technological Innovations in Bone Grafting

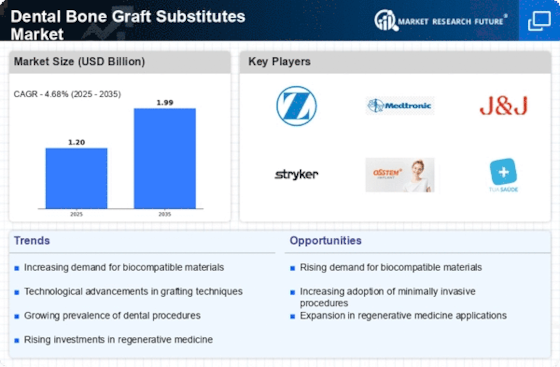

Technological advancements in bone grafting techniques and materials are reshaping the Dental Bone Graft Substitutes Market. Innovations such as 3D printing and bioactive materials enhance the effectiveness and efficiency of bone grafting procedures. These technologies not only improve the success rates of grafting but also reduce recovery times for patients. The introduction of synthetic grafts and advanced scaffolding materials has expanded the options available to dental surgeons, allowing for more tailored treatment plans. As these technologies continue to evolve, they are expected to drive market growth, with estimates suggesting a potential increase in market size by over 15% in the coming years. This trend indicates a shift towards more sophisticated and patient-centric approaches in the Dental Bone Graft Substitutes Market.

Aging Population and Increased Dental Procedures

The aging population is a significant driver of the Dental Bone Graft Substitutes Market. As individuals age, they often experience a higher incidence of dental problems, necessitating various dental procedures, including bone grafting. The demographic shift towards an older population is expected to result in a substantial increase in dental surgeries, thereby elevating the demand for bone graft substitutes. Recent statistics indicate that the number of dental procedures performed on older adults is rising, with projections suggesting a 20% increase in the next decade. This trend underscores the importance of dental bone graft substitutes in ensuring successful outcomes for these procedures, thereby propelling the market forward. The Dental Bone Graft Substitutes Market is likely to benefit from this demographic trend, as it aligns with the growing need for effective solutions in dental care.