North America : Technology Leadership and Innovation

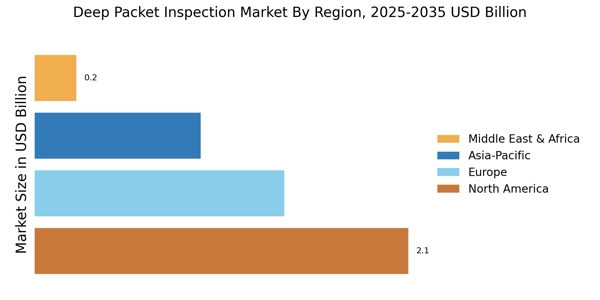

North America is the largest market for Deep Packet Inspection Market (DPI), holding approximately 45% of the global market share. The region's growth is driven by increasing cybersecurity threats, the demand for network optimization, and stringent regulatory requirements. The U.S. leads in DPI adoption, followed closely by Canada, as organizations seek to enhance their network performance and security measures. The competitive landscape in North America is robust, featuring key players such as Cisco Systems, IBM, and Juniper Networks. These companies are at the forefront of technological advancements, offering innovative solutions that cater to various sectors, including telecommunications and enterprise networks. The presence of these industry giants fosters a dynamic market environment, encouraging continuous improvement and investment in DPI technologies.

North America accounted for the largest deep packet inspection market share in 2024, driven by advanced cybersecurity infrastructure and early adoption of DPI technologies. Adoption of deep packet inspection in Canada is rising due to increasing regulatory compliance requirements and enterprise network modernization initiatives.

Europe : Regulatory Framework and Growth

Europe is the second-largest market for Deep Packet Inspection Market, accounting for approximately 30% of the global share. The region's growth is propelled by stringent data protection regulations, such as GDPR, and the increasing need for network security solutions. Countries like Germany and the UK are leading the charge, as enterprises prioritize compliance and data privacy, driving demand for DPI technologies. The competitive landscape in Europe is characterized by a mix of established players and emerging startups. Key companies like Nokia and Allot Communications are prominent, providing innovative DPI solutions tailored to meet regulatory requirements. The presence of a strong regulatory framework encourages investment in advanced technologies, ensuring that European enterprises remain competitive in the global market.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is witnessing rapid growth in the Deep Packet Inspection Market, holding around 20% of the global share. The region's expansion is driven by increasing internet penetration, the rise of smart devices, and the growing need for network management solutions. Countries like China and India are at the forefront, as they invest heavily in telecommunications infrastructure to support their burgeoning digital economies. The competitive landscape in Asia-Pacific is diverse, with both local and international players vying for market share. Companies such as NetScout Systems and Sandvine are making significant inroads, offering tailored solutions that address the unique challenges faced by regional enterprises. The increasing focus on cybersecurity and data analytics further fuels the demand for DPI technologies in this dynamic market.

Middle East and Africa : Emerging Market with Potential

The Middle East and Africa region is gradually emerging in the Deep Packet Inspection Market, holding about 5% of the global share. The growth is driven by increasing internet usage, mobile data consumption, and the need for enhanced network security. Countries like South Africa and the UAE are leading the way, as they invest in digital transformation initiatives to improve their telecommunications infrastructure. The competitive landscape in this region is still developing, with a mix of local and international players. Companies like Procera Networks and Viptela are establishing a presence, focusing on providing solutions that cater to the unique needs of the market. As governments prioritize digital initiatives, the demand for DPI technologies is expected to rise, presenting significant growth opportunities for stakeholders in the region.