Expansion of 5G Networks

The rollout of 5G networks in South Korea is poised to significantly impact the deep packet-inspection market. With the anticipated increase in data traffic and the proliferation of connected devices, the demand for advanced network management solutions is expected to surge. The deep packet-inspection market is likely to benefit from the need for enhanced visibility and control over network traffic, as organizations seek to optimize performance and ensure quality of service. By 2026, it is projected that 5G subscriptions in South Korea will exceed 30 million, leading to a corresponding rise in the complexity of network traffic. This scenario presents a substantial opportunity for deep packet-inspection technologies, which can provide insights into network behavior and facilitate efficient resource allocation.

Rising Cybersecurity Threats

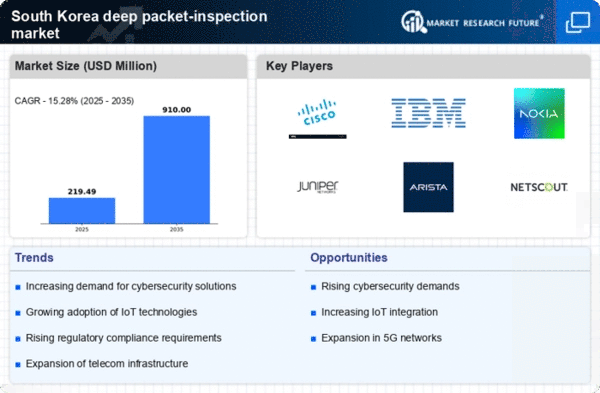

The increasing frequency and sophistication of cyberattacks in South Korea has heightened the demand for advanced security solutions, including those offered by the deep packet-inspection market. Organizations are increasingly recognizing the necessity of robust cybersecurity measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybersecurity spending in South Korea will reach approximately $10 billion, reflecting a growth rate of around 15% annually. This trend indicates a strong market potential for deep packet-inspection technologies, which provide real-time monitoring and analysis of network traffic to detect and mitigate threats effectively. As businesses and government entities prioritize cybersecurity, The deep packet-inspection market is likely to experience significant growth. This growth is driven by the need for enhanced protection against evolving cyber threats.

Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions in South Korea is influencing the deep packet-inspection market. As businesses migrate their operations to the cloud, the need for effective monitoring and management of cloud traffic becomes increasingly important. Deep packet-inspection technologies provide organizations with the capability to analyze data flows in real-time, ensuring that cloud applications operate efficiently and securely. The market for cloud services in South Korea is projected to grow by 25% annually, creating a substantial opportunity for deep packet-inspection solutions that cater to cloud environments. This trend indicates a growing recognition of the importance of maintaining visibility and control over cloud-based traffic, thereby driving demand for deep packet-inspection technologies.

Increased Data Privacy Regulations

The implementation of stringent data privacy regulations in South Korea is influencing the deep packet-inspection market. With laws such as the Personal Information Protection Act (PIPA) mandating strict compliance for data handling and processing, organizations are compelled to adopt technologies that ensure adherence to these regulations. The deep packet-inspection market plays a crucial role in enabling businesses to monitor and control data flows, ensuring that sensitive information is handled appropriately. As companies invest in compliance solutions, the market is projected to grow, with an expected increase of 20% in demand for deep packet-inspection technologies by 2026. This regulatory landscape creates a favorable environment for the deep packet-inspection market, as organizations seek to avoid penalties and enhance their data governance frameworks.

Growing Demand for Network Performance Optimization

As organizations in South Korea increasingly rely on digital services, the need for network performance optimization has become paramount. The deep packet-inspection market is well-positioned to address this demand by offering solutions that analyze and manage network traffic effectively. By providing insights into bandwidth usage and application performance, deep packet-inspection technologies enable organizations to enhance user experiences and reduce latency. In 2025, it is estimated that the market for network performance management solutions will grow by approximately 18%, driven by the need for seamless connectivity in various sectors, including finance, healthcare, and e-commerce. This trend underscores the critical role of the deep packet-inspection market in supporting organizations' efforts to optimize their network infrastructures.