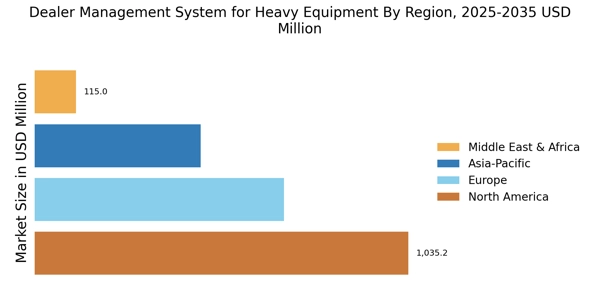

By Region, the study provides market insights into North America, Europe, Asia-Pacific, Middle East and Africa and South America. North America consists of the U.S, Canada, and Mexico.

The Dealer Management System for Heavy Equipment Market has a greater market share in North America due to the high demand for these products for vehicles especially in the U. S. and Canada. The increased demand for Dealer Management Systems (DMS) for heavy equipment in North America is associated with the fast-growing construction industry in the area. Constructions are important in the U. S economy whereby according to data early in 2023 the economy had over 919,000 construction establishments and provided employment to about 8 million people.

This industry accounts for almost $2 billion on salaries alone. building construction alone is worth over 1 trillion US dollars in terms of annual construction value, thus being a massive customer of hefty apparatus and corresponding services. In July 2024 construction spending was at an annual pace of $2162 billion. Currently there are 7 billion people in the world, up from the five and a half a billion people in 1999: this increase of 1 and a half billion is equivalent to 6%. That’s 7% higher than the year before last year, and 4% more than the last financial year.

Such growth points to the continued strong demand for construction services and therefore the various equipment that are required to execute various projects. Still, private and public construction spending are considerable, whereas private construction spending alone is estimated to be $1,678. Construction industry for private amounted to $7 billion while for the public construction was about $484. 0 billion annually. For instance, the construction of nonresidential building was estimated to be at $737. 260mln in July followed by 550mln in August and 290mln in September 2008, revealing the continuous investment in the commercial base.

In Europe, There is the rising demand of the Dealer Management Systems (DMS) for heavy equipment in Europe especially in the mining and quarrying industries which have expanded rapidly. The European union’s mining and quarrying industry in 2021 has produced € 101 which is billion euros. 9 billion of net turnover, which is 40% over the performance of the previous year. This fast growing is strong evidence of raw material and resources demand in construction and other physical developments requisite that necessitates smart handling of heavy equipment involved.

The Asia Pacific market is due to growth in the mining and construction industries that has led to increased demand for dealer management systems or DMS for heavy equipment in the Asia-pacific region. China’s Belt and Road Initiative (BRI) exponentially raises the investment on mining, which is estimated to touch $19. To reach $ 4 billion in 2023, the commerce company need to employ 158% more than current 2022.

The emphasis on minerals and metals concerning green energy transition and the need to transport copper, lithium, nickels are serving the purpose of imposing a robust demand of heavy equipment whether in Indonesia or Africa or any other. For instance, China based CATL has diversified in nickel mining in Indonesia; it was established that equipment management is critical hence efficient in that industry.At the same time, the construction industry in India is on the rise; it accounts for roughly 8 percent of the country’s GDP while delivering roughly $126 billion in value.

FIGURE 3: DEALER MANAGEMENT SYSTEM FOR HEAVY EQUIPMENT MARKET SIZE BY REGION 2023 VS 2032

Further, the major countries studied in the market report are the U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, and India.