Health Consciousness

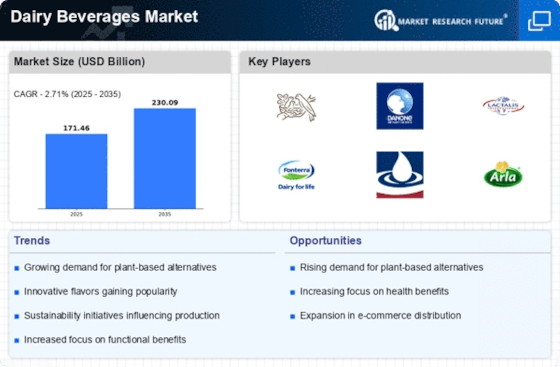

The increasing awareness of health and wellness among consumers appears to be a pivotal driver in the Dairy Beverages Market. As individuals become more health-conscious, they tend to seek out products that offer nutritional benefits. This trend is reflected in the rising demand for low-fat, probiotic, and fortified dairy beverages. According to recent data, the market for functional dairy beverages is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This shift towards healthier options indicates that consumers are prioritizing their well-being, thereby influencing manufacturers to innovate and diversify their product offerings in the Dairy Beverages Market.

Evolving Consumer Preferences

Evolving consumer preferences are a driving force in the Dairy Beverages Market, as tastes and dietary habits continue to change. The rise of alternative diets, such as veganism and lactose intolerance awareness, has led to an increased demand for lactose-free and plant-based dairy alternatives. Market data suggests that the lactose-free segment is expected to grow at a rate of around 8% annually. This shift indicates that consumers are actively seeking options that cater to their dietary needs, prompting manufacturers to diversify their product lines. As a result, understanding and adapting to these evolving preferences is essential for companies aiming to thrive in the Dairy Beverages Market.

Innovative Product Development

Innovation in product development is a significant driver within the Dairy Beverages Market. Companies are increasingly introducing new flavors, formulations, and packaging to attract a broader consumer base. For instance, the introduction of ready-to-drink dairy beverages and flavored milk options has gained traction, appealing to younger demographics. Market data suggests that the flavored milk segment is expected to witness a growth rate of around 5% annually. This emphasis on innovation not only caters to changing consumer preferences but also enhances brand loyalty, as unique offerings can differentiate products in a competitive landscape. Thus, the focus on innovative product development is likely to shape the future of the Dairy Beverages Market.

Sustainability and Ethical Sourcing

Sustainability has emerged as a crucial driver in the Dairy Beverages Market, as consumers increasingly prioritize environmentally friendly products. The demand for ethically sourced and sustainably produced dairy beverages is on the rise, prompting companies to adopt eco-friendly practices. This includes using recyclable packaging and sourcing milk from farms that adhere to sustainable practices. Market Research Future indicates that brands emphasizing sustainability can capture a larger share of the market, as consumers are willing to pay a premium for products that align with their values. Therefore, the commitment to sustainability is likely to play a significant role in shaping the Dairy Beverages Market in the foreseeable future.

Convenience and On-the-Go Consumption

The demand for convenience is increasingly influencing consumer behavior in the Dairy Beverages Market. As lifestyles become busier, consumers are seeking products that fit seamlessly into their daily routines. Ready-to-drink dairy beverages, such as single-serve bottles and portable packaging, are gaining popularity. Recent statistics indicate that the on-the-go segment of the dairy beverages market is projected to grow by approximately 7% in the coming years. This trend suggests that manufacturers are responding to consumer needs by providing convenient options that cater to a fast-paced lifestyle. Consequently, the focus on convenience is likely to drive growth and innovation within the Dairy Beverages Market.