Market Share

Introduction: Navigating the Evolving Landscape of Cyber Insurance

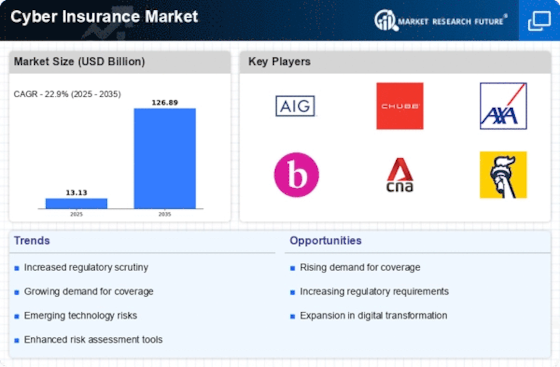

The cyber insurance market is being transformed by rapid technological developments, a regulatory environment that is becoming more demanding and an increasing demand for consumers to have more security in their digital lives. The leading players, including traditional insurance companies, insurtech start-ups and security companies, are competing to develop the best tools for risk assessment and claims handling. The IT system integrators are forming closer relationships with the hardware suppliers to offer complete solutions that include the IoT and biometrics. Companies are focusing more on their cyber resilience, and there are growth opportunities, especially in North America and Europe, where the regulatory framework is evolving to support the development of new insurance models. In 2024–25, the strategic deployment trends are focused on integrating green and sustainable practices to capture market share and meet the security needs of consumers.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive cyber insurance solutions, integrating risk assessment, policy management, and claims processing.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Travelers | Strong risk management capabilities | Cyber insurance and risk management | North America |

| Chubb | Global reach with tailored solutions | Cyber liability insurance | Global |

| Zurich Insurance | Robust underwriting expertise | Cyber insurance and risk solutions | Global |

| AXA XL | Innovative coverage options | Cyber insurance and risk management | Global |

Specialized Technology Vendors

These vendors focus on niche areas within cyber insurance, leveraging technology to enhance underwriting and claims processes.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Beazley | Expertise in cyber risk assessment | Cyber liability and data breach insurance | Global |

| Hiscox | Tailored solutions for SMEs | Cyber insurance for small businesses | North America, UK |

| CNA Financial | Comprehensive risk management services | Cyber insurance and risk solutions | North America |

Reinsurers

These vendors provide reinsurance solutions, supporting primary insurers with risk management and capital relief.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Munich Re | Strong analytical capabilities | Reinsurance for cyber risks | Global |

| Swiss Re | Innovative risk transfer solutions | Cyber reinsurance | Global |

Insurance Brokers

These vendors facilitate the placement of cyber insurance, providing expertise in policy selection and risk assessment.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Lockton | Personalized service and expertise | Insurance brokerage for cyber risks | Global |

| Williamson Group | Focused on niche markets | Cyber insurance brokerage | North America |

Diversified Insurers

These vendors offer a wide range of insurance products, including cyber insurance, leveraging their extensive market presence.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Berkshire Hathaway | Financial strength and stability | Comprehensive insurance solutions | Global |

| Liberty Mutual | Diverse product offerings | Cyber insurance and liability coverage | North America |

| AIG | Global expertise in risk management | Cyber insurance and liability | Global |

Emerging Players & Regional Champions

- CybSafe (UK): specializes in human-factors security training and risk management solutions, and has recently teamed up with a major UK bank to improve its cyber resilience. The company’s focus on human-factors cyber-security complements the traditional insurance model by addressing the root causes of security breaches.

- At-Bay (United States): Offers a unique combination of cyber-insurance and risk management. Recently a multi-million-dollar contract with a high-tech company. Their data-driven approach competes with the established players, offering real-time risk assessment and a tailored insurance cover.

- The Coalition (US): Provides a comprehensive cyber insurance policy that includes risk management tools and incident response services, and recently expanded its coverage to include ransomware attacks. Challenges traditional insurance by combining technology and insurance.

- Zguro (USA): Specializing in providing tailored cyber insurance solutions and risk management tools for small and medium-sized enterprises (SME). Recently launched a partnership with a major SME association. Their focus on the SME segment complements larger insurers, who may neglect this segment.

- Cybint (Israel): Offers cyber-insurance solutions combined with cyber-security training and awareness programs. It has recently launched a program for a government agency. This combined approach of insurance and training, based on prevention, challenges the existing model.

Regional Trends: In 2024, there will be a notable increase in the use of cyber insurance, especially in North America and Europe, due to the rising threat of cyber attacks and regulatory pressure. The demand for specialized insurance solutions that combine technology and risk management is rising. This is driving a shift towards more preventive insurance models. Also, SMEs are increasingly seen as a key market segment, and there is a growing trend towards tailored solutions for them.

Collaborations & M&A Movements

- Aon and Allianz entered into a partnership to develop tailored cyber insurance solutions aimed at small and medium-sized enterprises (SMEs), enhancing their competitive positioning in the growing SME market segment.

- Marsh McLennan acquired cyber risk analytics firm RiskLens in early 2024 to bolster its data-driven approach to cyber insurance underwriting, significantly increasing its market share in the analytics-driven insurance space.

- Chubb and IBM collaborated to integrate AI-driven risk assessment tools into Chubb's cyber insurance offerings, aiming to improve underwriting accuracy and customer engagement in a highly competitive landscape.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Risk Assessment Tools | AIG, Chubb | AIG utilizes advanced analytics to assess cyber risks, providing tailored coverage options. Chubb's Cyber Index offers real-time risk assessment, enhancing client understanding of their exposure. |

| Incident Response Services | Beazley, Travelers | Beazley offers a comprehensive incident response service that includes a 24/7 hotline and access to cybersecurity experts. Travelers provides a unique 'cyber response team' that assists clients during a breach. |

| Policy Customization | CNA, AXA | CNA allows clients to customize their policies based on specific industry needs, enhancing relevance. AXA's modular approach enables businesses to select coverage that aligns with their unique risk profiles. |

| Claims Management | Liberty Mutual, Zurich | Liberty Mutual has streamlined claims processing through digital platforms, reducing turnaround time. Zurich's claims management includes proactive communication, ensuring clients are informed throughout the process. |

| Cybersecurity Partnerships | Hiscox, Munich Re | Hiscox partners with cybersecurity firms to provide clients with preventative measures and risk mitigation strategies. Munich Re collaborates with tech companies to enhance their underwriting processes with real-time data. |

Conclusion: Navigating the Cyber Insurance Landscape

The competitive landscape of the cyber insurance market is increasingly characterized by the fragmentation of the market, where the main players of the past and the newcomers are fighting for the same market share. In addition, the demand for tailored solutions is growing, especially in North America and Europe, where the regulatory pressure is increasing. Strategic positioning by leveraging advanced capabilities such as artificial intelligence and automation in the risk assessment and claim handling processes is necessary. In addition, the client will seek to work with an insurer that can adapt to the changing cyber threats and regulatory environment. As the market matures, innovation and the ability to respond to the needs of the client will become the key to success.

Leave a Comment