Top Industry Leaders in the Cyber Insurance Market

Competitive Landscape of Cyber Insurance Market: A Deep Dive

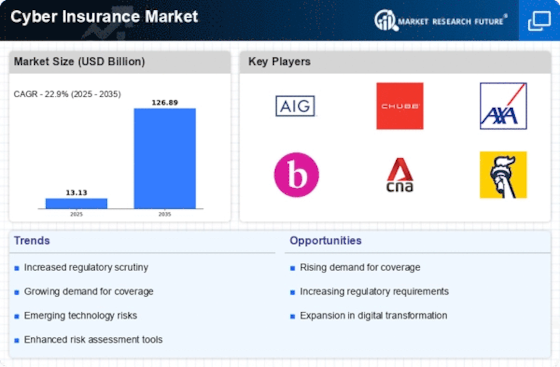

The cyber insurance market is experiencing explosive growth, propelled by the ever-evolving threat landscape and the increasing reliance on digital infrastructure. This dynamic arena boasts a diverse range of established players and emerging disruptors, each vying for a slice of the lucrative pie. Understanding the competitive landscape is crucial for insurers, brokers, and businesses alike, as it provides insights into market trends, potential risks, and future directions.

Key Players:

- Tata Consultancy Services Limited (India)

- Guy Carpenter and Company LLC. (U.S.)

- At-Bay Inc. (U.S.)

- Lloyds Bank PLC (U.K.)

- AXA SA (France)

- Cisco Systems Inc. (U.S.)

- Chubb Limited (Switzerland)

- Apple Inc. (U.S.)

- American International Group Inc. (U.S.)

- Zurich Insurance Group (Switzerland)

- Beazley Group PLC (U.K.)

- Lockton Companies (U.S.)

Strategies for Success:

- Product Differentiation: Offering specialized coverages for emerging threats like ransomware, supply chain attacks, and cloud security vulnerabilities.

- Risk-Based Underwriting: Utilizing data-driven tools and threat intelligence to assess risk profiles and tailor premiums accordingly.

- Incident Response and Cybercrime Investigation: Providing comprehensive post-breach support services, including incident response, forensic investigations, and legal advice.

- Risk Management and Security Consulting: Partnering with clients to implement proactive security measures, vulnerability assessments, and employee training programs.

- Technology Adoption: Embracing AI, blockchain, and advanced analytics to enhance fraud detection, claims processing, and overall efficiency.

Factors for Market Share Analysis:

- Gross Written Premium (GWP): Indicates the total amount of premium collected by an insurer.

- Net Loss Ratio: Measures the percentage of premium used to pay claims, reflecting an insurer's profitability.

- Loss Adjustment Expense Ratio (LAE): Measures the cost of investigating and settling claims.

- Customer Retention Rate: Reflects an insurer's ability to maintain existing clients.

- Brand Recognition and Reputation: Plays a significant role in attracting new clients.

- Geographical Presence and Market Focus: Strong regional presence and specialization in specific industries can provide a competitive edge.

Emerging Players and Trends:

- Captive Insurers: Large corporations are forming their own captive insurance companies to manage cyber risks and reduce reliance on traditional insurers.

- Cybersecurity Service Providers: Cybersecurity firms are expanding into cyber insurance, offering bundled solutions that combine risk mitigation services with insurance coverage.

- Parametric Insurance: This innovative approach uses real-time data (e.g., website downtime) to trigger payouts, offering faster and more efficient claims settlement.

- Open Insurance Platforms: Collaborative platforms facilitate data sharing and product development, enabling insurers to offer more tailored and comprehensive solutions.

Investment Trends:

- Insurers are investing heavily in cyber security expertise, data analytics platforms, and AI-powered underwriting tools.

- Partnerships and acquisitions are on the rise, as established players seek to expand their offerings and acquire new technologies.

- Focus on international expansion, particularly in emerging markets with high cyber risk exposure.

- Investments in cyber education and awareness programs to improve risk management practices among clients.

Latest Company Updates:

Amazon Web Services is launching a new programme in 2023 that guarantees consumers a security insurance quote within two days, along with enormous revenue prospects for the channel. AWS, the $85 billion global cloud market share leader, announced the launch of its new AWS Cyber Insurance Programme. The programme is designed to assist AWS customers in improving their security posture and becoming covered as soon as possible, easing the sometimes-laborious process of acquiring a client the cybersecurity insurance they want or need.

Today, At-Bay, the InsurSec supplier for the digital age, announced the launch of At-Bay StanceTM Managed Detection and Response (At-Bay Stance MDR), a new MDR solution designed to help emerging and mid-sized organisations enhance their security defences in 2023.

At-Bay thinks that over 50% of its clients' cyber insurance claims might have been avoided with an efficient MDR solution based on an analysis of its claims data over the previous two years.

At-Bay, a provider of cybersecurity solutions, formally unveiled a new managed detection and response (MDR) cybersecurity solution for small and mid-sized organisations in 2023. In response to rising cybercrime rates, At-Bay Stance Managed Detection and Response (At-Bay Stance MDR) seeks to enable developing and mid-sized organisations to fortify their cybersecurity defences and readiness.

A brand-new managing general agent (MGA) named Pera was launched in 2023 by USQRisk, a multinational managing general agency that specialises in alternative risk transfer solutions. Pera is going to offer blended cyber and technology errors and omissions (E&O) as well as cyber insurance.