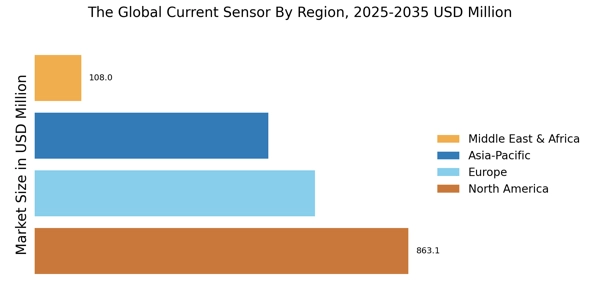

The report on the Current Sensor Market has been segmented on the basis of region as: North America, Europe, Asia Pacific, Middle East & Africa, and South America. The Asia-Pacific Current Sensor Market accounted for the largest market share in 2024, and Asia-Pacific is expected to exhibit significant CAGR growth during the study period. The current sensor market in the APAC region is witnessing significant growth and development, with key countries such as China, Japan, South Korea, India, and the rest of APAC at the forefront of this transformation.

The current sensor market in the Asia-Pacific (APAC) region is experiencing substantial growth and transformation. Key countries such as China, Japan, South Korea, India, and other APAC nations are at the forefront of advancing this industry. Governments throughout the APAC region are actively investing in current sensor technologies to enhance various sectors, from manufacturing to energy management and beyond. The current sensor market is marked by robust growth, driven by the country's expanding manufacturing sector and the increasing demand for automation.

For instance, Chinese manufacturers are adopting current sensors for various applications, such as motor control, solar power generation, and power management. For instance, in June 2022, the introduction of LEM's solar current sensor made with BASF's Ultramid® in China has enhanced the reliability and accuracy of solar power generation in the APAC region, boosting market expansion and competitive advantage. This innovative technology aligns with sustainability goals and has fostered collaborations between local companies, driving growth in the APAC current sensor market. Asia-Pacific remains a key growth hub for the current sensor market, supported by strong manufacturing activity and expanding adoption across the broader sensor market.

The European current sensor market has been analysed across key countries, including the United Kingdom, Germany, France, Spain, and rest of the Europe. Europe’s focus on energy efficiency and electrification is boosting demand for advanced electric current sensor and current indicator solutions. The European current sensor market is experiencing robust growth, driven by a confluence of factors that reflect the region's commitment to energy efficiency, sustainability, and technological innovation. One of the primary drivers of this growth is the continent's unwavering focus on energy efficiency. Europe has actively promoted sustainability and reduced energy consumption, spurring demand for current sensors across various applications.

These sensors have become integral to industrial automation, smart grid systems, and electric vehicles, all contributing to the reduction of energy consumption and greenhouse gas emissions. The transition towards electric mobility is another significant factor. Europe's automotive industry has been quick to adapt to stringent emissions standards by embracing electric and hybrid vehicles. Current sensors play a pivotal role in these EVs, monitoring battery and motor performance, ensuring safety, and optimizing energy usage. Europe's commitment to renewable energy integration is also propelling the current sensor market forward.

Substantial investments in wind and solar power require efficient and safe electrical current monitoring, where current sensors are indispensable

Figure 2: GLOBAL CURRENT SENSOR MARKET, BY REGION, 2024 & 2035 (USD Million)

Further, the major countries studied in the market report are the U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, Japan, UAE, South Africa, Saudi Arabia, Argentina, and Brazil.