Growing Concerns Over Cybersecurity

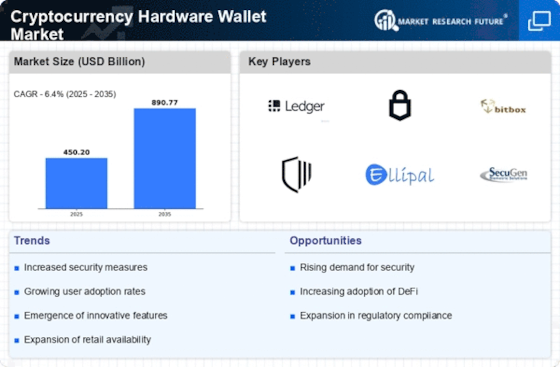

In an era where cyber threats are becoming increasingly sophisticated, the Cryptocurrency Hardware Wallet Market is witnessing heightened demand for secure storage solutions. Cybersecurity breaches have led to significant financial losses, prompting users to seek hardware wallets that offer robust protection against unauthorized access. The market for cybersecurity solutions is projected to reach over 300 billion by 2025, underscoring the urgency for secure cryptocurrency storage. This growing concern over cybersecurity is likely to drive consumers towards hardware wallets, which are perceived as a safer alternative to software wallets. As a result, the Cryptocurrency Hardware Wallet Market is expected to expand as users prioritize the security of their digital assets.

Integration of Advanced Technologies

The Cryptocurrency Hardware Wallet Market is benefiting from the integration of advanced technologies such as biometric authentication and multi-signature capabilities. These innovations enhance the security and usability of hardware wallets, making them more appealing to consumers. For instance, biometric features allow users to unlock their wallets using fingerprints or facial recognition, adding an extra layer of security. The market for biometric technology is anticipated to grow significantly, which may further influence the Cryptocurrency Hardware Wallet Market. As technology continues to evolve, hardware wallets that incorporate these advancements are likely to attract a broader audience, thereby driving market growth.

Regulatory Developments and Compliance

The Cryptocurrency Hardware Wallet Market is influenced by ongoing regulatory developments that aim to establish a secure framework for cryptocurrency transactions. As governments and regulatory bodies implement stricter compliance measures, the demand for hardware wallets that adhere to these regulations is expected to rise. This trend indicates that consumers are becoming more aware of the importance of compliance in safeguarding their investments. The market for compliance solutions is projected to grow, which may positively impact the Cryptocurrency Hardware Wallet Market. As regulations evolve, hardware wallet manufacturers that prioritize compliance are likely to gain a competitive edge.

Increasing Adoption of Cryptocurrencies

The Cryptocurrency Hardware Wallet Market is experiencing a surge in demand due to the increasing adoption of cryptocurrencies by individuals and businesses alike. As more people recognize the potential of digital currencies, the need for secure storage solutions becomes paramount. According to recent estimates, the number of cryptocurrency users has surpassed 300 million, indicating a growing market. This trend suggests that as the user base expands, so too does the necessity for hardware wallets that provide enhanced security features. The Cryptocurrency Hardware Wallet Market is thus positioned to benefit from this rising interest, as consumers seek reliable methods to safeguard their digital assets against theft and hacking.

Rising Institutional Investment in Cryptocurrencies

The Cryptocurrency Hardware Wallet Market is experiencing a notable shift as institutional investors increasingly enter the cryptocurrency space. This influx of institutional capital is driving demand for secure storage solutions, as these investors require reliable methods to protect their assets. Reports indicate that institutional investment in cryptocurrencies has grown significantly, with major financial institutions allocating funds to digital assets. This trend suggests that as institutional interest continues to rise, the need for hardware wallets that cater to this segment will also increase. Consequently, the Cryptocurrency Hardware Wallet Market is poised for growth as it adapts to the evolving needs of institutional investors.