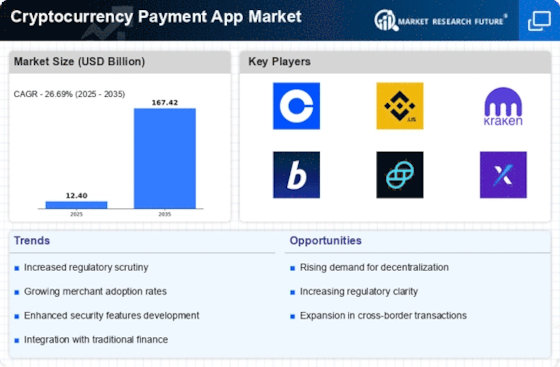

Increased Regulatory Clarity

The Cryptocurrency Payment App Market is benefiting from a gradual increase in regulatory clarity across various jurisdictions. Governments and regulatory bodies are beginning to establish frameworks that provide guidance on the use of cryptocurrencies and related technologies. This trend is fostering a more secure environment for users and businesses alike. In 2025, it is anticipated that over 60 countries will have implemented comprehensive regulations governing cryptocurrency transactions, which could enhance consumer confidence in using payment applications. As regulatory frameworks become more defined, businesses are more likely to adopt cryptocurrency payment solutions, knowing they are operating within legal parameters. This increased regulatory clarity is expected to stimulate growth within the Cryptocurrency Payment App Market, as it encourages wider acceptance and integration of digital currencies into everyday transactions.

Growing Consumer Awareness and Education

The Cryptocurrency Payment App Market is experiencing a rise in consumer awareness and education regarding digital currencies. As more individuals become informed about the benefits and functionalities of cryptocurrencies, the demand for payment applications is likely to increase. In 2025, surveys indicate that approximately 40% of consumers are familiar with cryptocurrency concepts, compared to just 10% in previous years. This growing awareness is fostering a more informed user base that is willing to engage with cryptocurrency payment solutions. Educational initiatives, including online courses and community workshops, are contributing to this trend by demystifying digital currencies and their applications. As consumers become more knowledgeable, they are more likely to adopt cryptocurrency payment apps for everyday transactions, thereby driving growth within the Cryptocurrency Payment App Market.

Technological Advancements in Blockchain

The Cryptocurrency Payment App Market is poised for growth due to ongoing technological advancements in blockchain technology. Innovations such as layer-2 scaling solutions and interoperability protocols are enhancing the efficiency and usability of cryptocurrency payment applications. In 2025, the market for blockchain technology is projected to reach 67 billion USD, underscoring the potential for integration with payment solutions. These advancements are likely to reduce transaction times and costs, making cryptocurrency payments more appealing to users. Furthermore, as blockchain technology continues to evolve, it may enable new functionalities within payment applications, such as smart contracts and automated compliance features. This technological evolution is expected to drive the Cryptocurrency Payment App Market forward, as developers and businesses leverage these innovations to create more robust and user-friendly payment solutions.

Rising Interest in Cross-Border Transactions

The Cryptocurrency Payment App Market is witnessing a significant increase in interest surrounding cross-border transactions. As businesses expand their operations internationally, the need for efficient and cost-effective payment solutions becomes paramount. Cryptocurrency payment applications offer a viable alternative to traditional remittance services, which often incur high fees and lengthy processing times. In 2025, it is estimated that cross-border payment volumes will exceed 30 trillion USD, highlighting the potential for cryptocurrency solutions to capture a share of this market. The ability to facilitate instant transactions across borders, coupled with reduced transaction costs, positions cryptocurrency payment apps as attractive options for both consumers and businesses. This growing demand for cross-border payment solutions is likely to propel the Cryptocurrency Payment App Market forward, as users increasingly seek to leverage the advantages of digital currencies.

Growing Demand for Decentralized Finance Solutions

The Cryptocurrency Payment App Market is experiencing a notable surge in demand for decentralized finance (DeFi) solutions. As consumers and businesses seek alternatives to traditional banking systems, the appeal of DeFi applications becomes increasingly pronounced. In 2025, the total value locked in DeFi protocols has reached approximately 100 billion USD, indicating a robust interest in decentralized financial services. This trend suggests that cryptocurrency payment applications, which facilitate seamless transactions within DeFi ecosystems, are likely to gain traction. Users are drawn to the potential for lower fees, increased transparency, and enhanced control over their assets. Consequently, the proliferation of DeFi solutions is expected to drive innovation and competition within the Cryptocurrency Payment App Market, fostering an environment conducive to growth and user adoption.