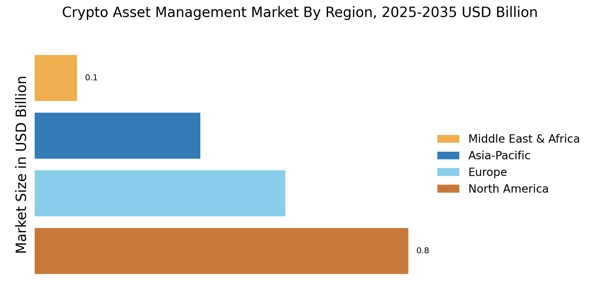

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American crypto asset management market is anticipated to expand at a significant CAGR during the study period, accounting for USD 0.388 billion in 2021. This is attributed to number of factors such as penetration of new industries and improvement in economy. The introduction and early adoption of the solution are driving the market opportunities in the region. Also, the region has several prominent players offering dedicated solutions across the industry vertical.

In addition, presence of large number of cloud crypto solution vendors across the U.S. and Canada is expected to provide lucrative opportunities for the market. In June 2020, BitPay, the blockchain payments provider, launched the BitPay Card, the first Mastercard Prepaid card for crypto users in the United States.

Moreover, the major countries covered in the market report include the United States, Germany, Canada, France, the United Kingdom, Italy, Spain, India, Japan, Australia, China, South Korea, and Brazil.

Figure 3: Crypto Asset Management Market Share By Region 2022

The European crypto asset management market is the world's second-largest due to the increasing interest in cryptocurrencies and growing acceptance of cryptocurrency payments within the region. The rapidly growing banking and financial investment in the region are boosting the crypto asset management market. The region is also witnessing remarkable growth in blockchain application in the financial industry. This is expected to drive the adoption of crypto asset management solutions across European countries. Further, the German crypto asset management market held the largest market share, and the France crypto asset management market was the fastest-growing market in the European region.

The Asia Pacific crypto asset management market is expected to grow at the fastest rate of CAGR during the forecast period owing to wide presence of large number of crypto mining enterprises, which are turning toward hosted crypto asset management solutions to efficiently manage their business processes, particularly in developing countries such as China, India, and Singapore. The increasing digitalization, online transaction, boost in the economy among others are the factors further contributing to the growth of the market in the region.

Rapid advancements in the network infrastructure, cloud computing, economic growth, and stable geopolitical system have provided a platform for the growth of solution providers in the region. The presence and use of digital currency significantly influence the financial system in the Asia Pacific markets. The growth of cryptocurrencies has attracted many large financial institutions to achieve greater business agility in the banking systems. Cryptocurrency, which is powered by blockchain technology, allows institutional clients to conduct transactions and exchanges, thus trading more quickly. Digital currency does not need any third-party intervention owing to its decentralized networks.

Moreover, China’s crypto asset management market held the largest market share, and the Indian crypto asset management market was the fastest-growing market in the Asia-Pacific region.